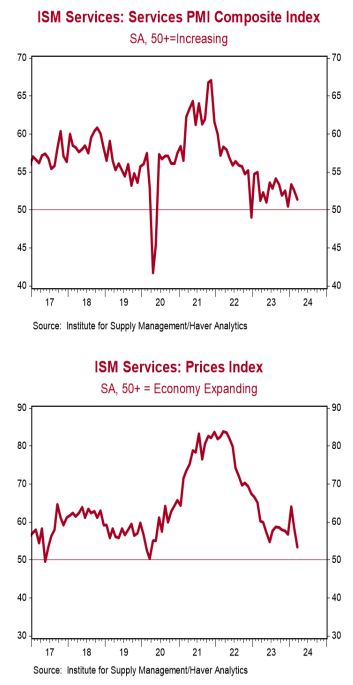

- The ISM Non-Manufacturing index declined to 51.4 in March, lagging the consensus expected 52.8. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mixed in March. The new orders index declined to 54.4 from 56.1, while the business activity index ticked up to 57.4 from 57.2. The employment index rose to 48.5 from 48.0, while the supplier deliveries index dropped to 45.4 from 48.9.

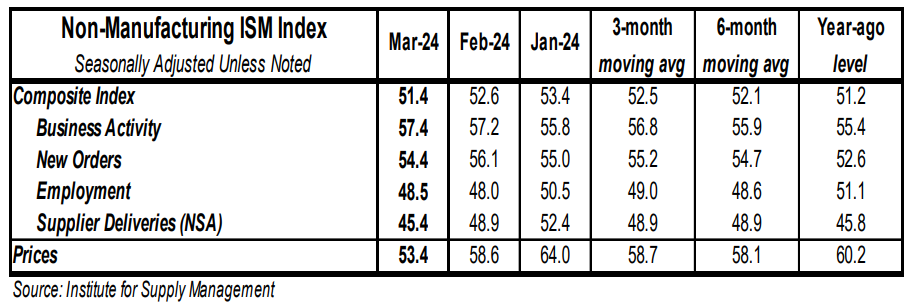

- The prices paid index declined to 53.4 in March from 58.6 in February.

Implications: The services sector continued to expand in March, but the pace of growth slowed. The headline index declined to 51.4 in March, missing the consensus expected 52.8, with twelve out of eighteen major industries reporting growth, four reporting contraction, and two reporting no change. Looking at the details, the indexes for business activity and new orders – the two forward-looking pieces of the report – were a mixed bag in March. The index for new orders took a breather from the six-month high it set in February, while the index for business activity ticked up to a solid 57.4. Along with slower new orders, the pullback in the headline index was due to faster deliveries in March (signaled by a lower sub-50 reading in the supplier deliveries index), and the employment index remaining in contraction territory. (Faster deliveries signal fewer bottlenecks and therefore the potential of weaker demand.). Hiring activity in the services sector looks to be cooling, as the index sat in contraction territory for the third time in four months. Survey comments reiterate the continued struggle finding qualified labor, while the number of major industries reporting an increase in employment in March versus a decrease was nearly the same. On the inflation front, prices continued to rise in the services sector, now for the 82nd month in a row. Although the index is well below the back-breaking pace from 2021-22, inflation remains a problem in the services sector; thirteen industries reporting paying higher prices during the month of March. What do we expect this year? An eventual weakening in services activity as the economic morphine from COVID wears off and the impact of the recent reductions in the M2 measure of the money supply make their way through the economy. We continue to believe a recession is on the way and think investors should stay cautious as we move through these unprecedented times. In other news this morning, ADP’s measure of private payrolls increased 184,000 in March versus a consensus expected 150,000. We expect Friday’s payroll report to show a nonfarm payroll gain of 212,000. Also yesterday, cars and light trucks were sold at a 15.5 million annual rate in March, down 1.3% from February, but up 3.7% from a year ago.