View from the Observation Deck

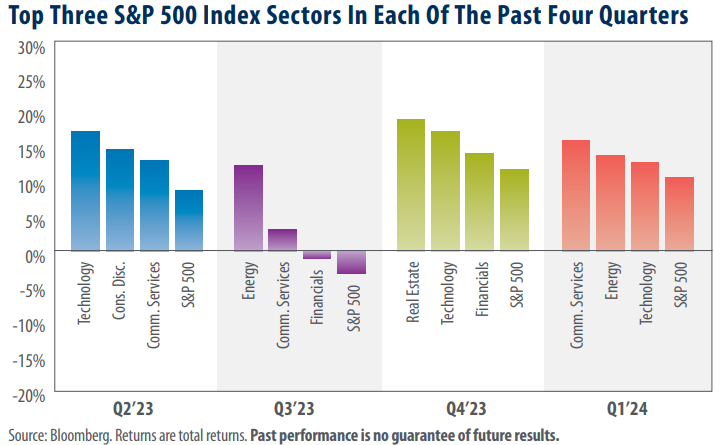

One of the most common questions we field on an ongoing basis is the following: What are your favorite sectors? Today’s blog post is one that we update on a quarterly basis to lend context to our responses. Sometimes the answer is more evident than at other times, and sometimes it only makes sense via hindsight. While the above chart does not contain yearly data, only two sectors in the S&P 500 Index have been the top-performer in back-to-back calendar years since 2005. Information Technology was the first, posting the highest total return in 2019 (+50.29%) and 2020 (43.89%). Energy was the second, posting the highest total return in 2021 (54.39%) and 2022 (65.43%), according to data from Bloomberg.

• The top-performing sectors and their total returns in Q1’24 were as follows: Communication Services (15.82%), Energy (13.69%), and Technology (12.69%). The total return for the S&P 500 Index was 10.55% over the period. The other eight sectors generated total returns ranging from 12.45% (Financials) to -0.55% (Real Estate).

• By comparison, the top-performing sectors and their total returns in Q1’23 were as follows: Technology (21.82%), Communication Services (20.50%), and Consumer Discretionary (16.05%). The worst-performing sectors for the period were: Health Care (-4.31%), Energy (-4.71%), and Financials (-5.56%).

• Advancements in Artificial Intelligence (AI) continue to be a catalyst to the S&P 500 Communication Services and Information Technology Indices in 2024. At 49.76% and 46.01%, respectively, the trailing 12-month total returns for the Communication Services and Information Technology Indices were the highest of the eleven sectors that comprise the S&P 500 Index through the end of March 2024. For comparison, the total return of the S&P 500 Index was 29.86% over the same time frame. Each of the eleven major sectors that comprise the S&P 500 Index were positive on a total return basis over the period.

• Click here to access the post featuring the top-performing sectors in Q2’22, Q3’22, Q4’22 and Q1’23.

Takeaway

As we can observe from today’s chart, the top-performing sector often varies from quarter to quarter. Of the eleven sectors that make up the S&P 500 Index, the Communication Services and Information Technology Indices boast the highest total returns on a trailing 12-month basis (49.76% and 46.01%, respectively). Even so, they have only claimed the top spot in two of the last four quarters. That said, developments in AI continue to bolster revenue expectations for these companies. On March 29, 2024, data from Bloomberg revealed that revenues for the companies that comprise the S&P 500 Technology and Communication Services Indices are forecast to grow by 9.30% and 7.32%, respectively, in 2024. The figures represent the highest year-over-year revenue growth estimate of the eleven sectors that comprise the broader S&P 500 Index. Revenue growth estimates for the S&P 500 Health Care Index, which is notably absent from today’s chart, came in third at 6.64%. Will a different sector rise to the top in the second quarter of 2024? We look forward to seeing what the data reveals.