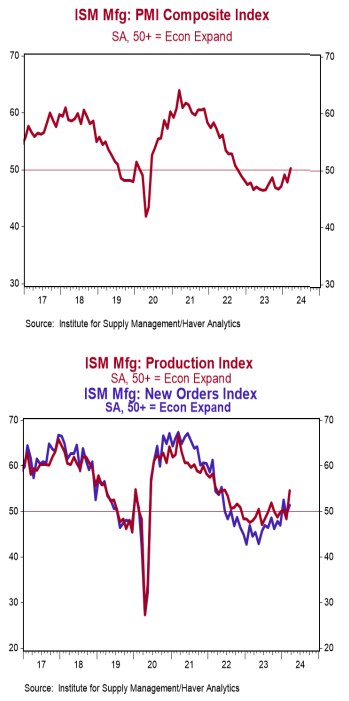

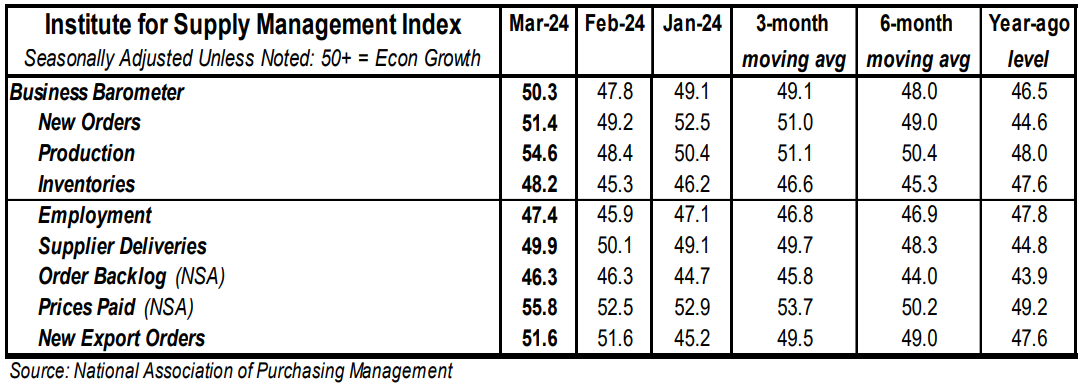

- The ISM Manufacturing Index rose to 50.3 in March, beating the consensus expected 48.3. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mostly higher in March. The production index rose to 54.6 from 48.4 in February and the new orders index increased to 51.4 from 49.2. The employment index rose to 47.4 from 45.9 in February, while the supplier deliveries index ticked down to 49.9 from 50.1.

- The prices paid index increased to 55.8 in March from 52.5 in February.

Implications: The ISM Manufacturing Index showed some signs of life in March, rising to 50.3, and beating even the most optimistic forecast from any economics group surveyed by Bloomberg. The reading above 50 signals that activity in the US manufacturing sector expanded in March (albeit barely), snapping sixteen consecutive months of contraction. Looking at the details of the report, half of the eighteen major manufacturing industries reported growth in March, with six reporting contraction, and three reporting no change. Both demand and production were responsible for the rise in the overall index, as the index for production jumped to 54.6 from 48.4, while the new orders index broke back into expansion territory for only the second time in the last nineteen months. Survey comments described continued demand softness, but optimism that order activity will pick up in the second quarter. Despite this optimism, demand remains soft in the manufacturing sector. When looking at the big picture, goods-related activity was artificially boosted during the COVID lockdowns, but then the economy reopened, and consumers began shifting their spending preferences back to a more normal mix, away from goods and back to services. The ISM index peaked in March 2021 (the last month federal stimulus checks were sent out) and has been weaker ever since. We continue to believe a recession is coming this year and the manufacturing sector is likely to lead the way. Case in point, hiring activity in the manufacturing sector contracted for the sixth consecutive month as companies continued reducing headcounts in March with significant layoff activity. We believe investors should remain cautious as the monetary and fiscal stimulus during COVID wears off. Last but not least, the highest reading of any category in the report came from the prices index, which increased to 55.8 in March. After sitting in contraction territory for most of 2023, the prices index has been above 50 each month in 2024, signaling higher prices. This is not a good sign for the Fed, as the goods sector has been a key driver for lower inflation readings over the last year. In other news this morning, construction spending declined 0.3% in February, as a sizeable increase in homebuilding was not enough to offset broad declines across most other major construction categories.