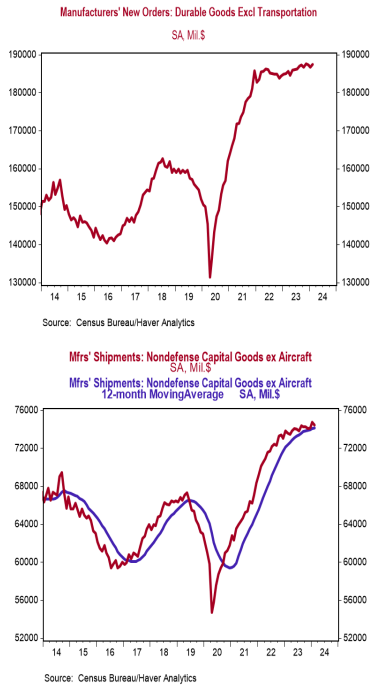

- New orders for durable goods rose 1.4% in February (+0.6% including revisions to prior months), versus a consensus expected gain of 1.0%. Orders excluding transportation rose 0.5% (+0.6% including revisions), narrowly beating a consensus expected +0.4%. Orders are up 2.6% from a year ago, while orders excluding transportation have risen 1.3%.

- A surge in orders for commercial aircraft and autos led gains across most major categories in February.

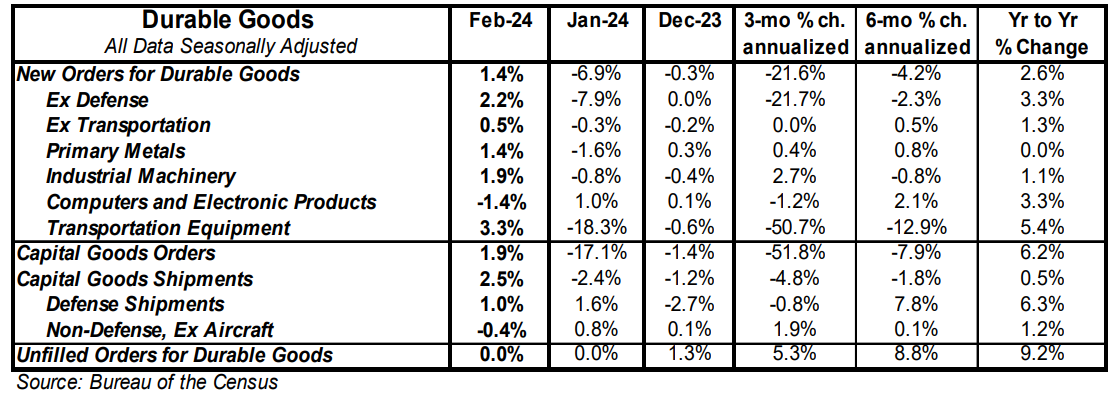

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure declined 0.4% in February. If unchanged in March, these orders would be up at a 1.9% annualized rate in Q1 versus the Q4 average.

- Unfilled orders were unchanged in February but are up 9.2% in the past year.

Implications: Durable goods orders rebounded partially in February, gaining 1.4%, after a steep drop in January. The largest gain came for orders of commercial aircraft, up 24.6% in February, while motor vehicles and parts rose a solid 1.4%. After factoring in downward revisions to January, orders rose a more modest 0.6%. Strip out the typically volatile transportation sector and orders rose 0.5% in February (+0.6% including revisions), more than offsetting the 0.3% drop in January. Looking at the details of the report shows rising orders across most major non-transportation categories – led by machinery (+1.9%) and primary metals (+1.4%) – which were partially offset by declining orders for computers and electronic products (-1.4%) as well as electrical equipment (-1.5%). The most important number in the release, core shipments – a key input for business investment in the calculation of GDP – declined 0.4% in February. If unchanged in March, these orders would be up at a 1.9% annualized rate in Q1 versus the Q4 average. Shipments have been trending lower since the start of 2022, and we expect this trend to continue as the economy feels the lagged effects of the Federal Reserve’s actions to tighten monetary policy. Consistent with other economic data, orders and shipments for durable goods have been very choppy of late, and we expect a number of factors will keep the path forward rocky as we move through 2024: monetary policy from the Federal Reserve, the withdrawal symptoms following the COVID-era economic morphine that artificially boosted both consumer and business spending, and the return toward services that likely means goods-related activity will continue to soften in the year ahead, even as some durables that facilitate services remain healthy. In other manufacturing news this morning, the Richmond Fed index, a measure of mid-Atlantic factory activity, fell to -11.0 in March from -5.0 in February. Meanwhile, on the housing front, home prices were mixed in January, with the national Case-Shiller index up 0.4% while the FHFA index ticked down 0.1%. In the last twelve months, these indices are up 6.0% and 6.3%, respectively.