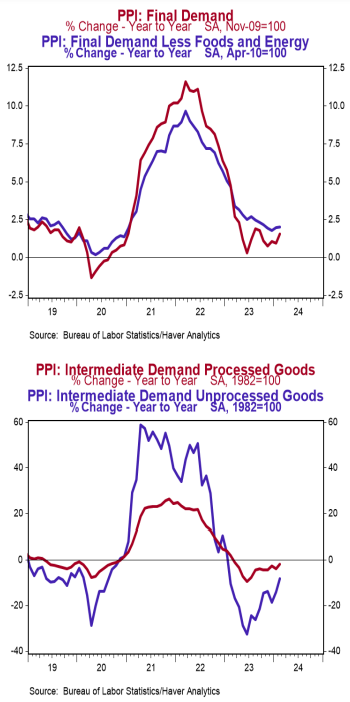

- The Producer Price Index (PPI) rose 0.6% in February, coming in well above the consensus expected +0.3%. Producer prices are up 1.6% versus a year ago.

- Energy prices rose 4.4% in February, while food prices increased 1.0%. Producer prices excluding food and energy rose 0.3% in February and are up 2.0% versus a year ago.

- In the past year, prices for goods have risen 0.3%, while prices for services have increased 2.3%. Private capital equipment prices declined 0.1% in February but are up 0.9% in the past year.

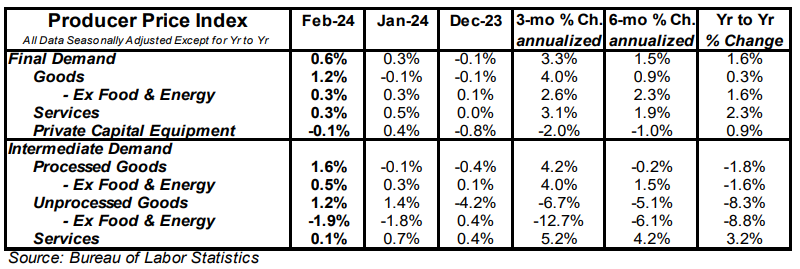

- Prices for intermediate processed goods increased 1.6% in February but are down 1.8% versus a year ago. Prices for intermediate unprocessed goods rose 1.2% in February but are down 8.3% versus a year ago.

Implications: When Chairman Powell said the FOMC is looking for greater confidence that inflation is trending lower before they begin cutting rates, this is not what he had in mind. While consumer prices continue to run too hot for comfort, producer prices further back in the supply chain jumped 0.6% in February, easily outpacing consensus expectations. February inflation was led by a 4.4% rise in energy prices, a category which had shown steady decline over the prior four months and is down 3.8% from a year ago. Food prices – the other typically volatile category – rose 1.0% in February and are up 0.3% in the past twelve months. Stripping out these two components shows “core” prices rose 0.3% in February, following an outsized 0.5% increase in January. The Fed can take solace in noting the twelve-month rise in core prices has eased since peaking at 9.7% back in March of 2022, and is now up a moderate 2.0% from a year ago, but the trend of late has turned back higher, with core prices up 2.9% at an annualized rate over the past three months. Diving into the details of today’s PPI report shows core inflation was spread between goods and services, with prices for nondurable consumer goods, transportation and warehousing, and outpatient care leading the charge. Further back in the pipeline, processed goods prices rose 1.6% in February but remain down 1.8% in the past year. Meanwhile unprocessed goods prices rose 1.2% in February but are down 8.3% in the past year. Further easing in inflation appears on the way should the Fed have the patience to let a tighter monetary policy do its work. But inflation risks rearing its ugly head once again should the Fed falter and cut rates too quickly. The markets – and the Fed itself – seem unsure how soon or how quickly rate cuts will come. Patience is a virtue.