View from the Observation Deck

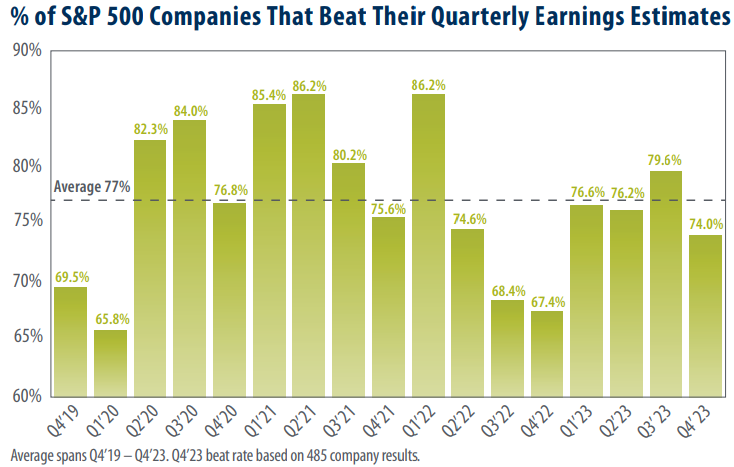

We update this post on an ongoing basis to provide investors with insight into the earnings beat rate for the companies that comprise the S&P 500 Index (“Index”). As many investors may know, equity analysts adjust their corporate earnings estimates higher or lower on an ongoing basis. While these estimates may provide insight into the expected financial performance of a given company, they are not guarantees. From Q4’19 through Q4’23 (the 17 quarters in today’s chart), the average earnings beat rate for the companies that comprise the Index was 77.0%.

As indicated in today’s chart, in Q4’23, the percentage of companies in the Index that reported higher than expected earnings stood three percentage points below the 4-year average of 77.0%.

After rising to 79.6% in Q3’23, the earnings beat rate for the Index fell back below its 4-year average, settling at 74.0% in Q4’23. Keep in mind that the Q4’23 data in the chart reflects earnings results for 485 of the 503 companies that comprise the Index and could change slightly over the coming weeks.

As of 2/29/24, the sectors with the highest earnings beat rates and their percentages were as follows: Information Technology (88.1%); Industrials (82.1%); and Consumer Staples (80.7%), according to S&P Dow Jones Indices. Real Estate had the lowest beat rate at 45.2%. Notably, the Real Estate sector also had the highest earnings miss rate, at 41.9% during the quarter.

Analyst’s Q1’24 earnings estimates have fallen by a smaller percentage than historical averages.

Analysts do not appear to be overly concerned about the most recent quarter-over-quarter decline in the earnings beat rate. Data from FactSet revealed that Q1’24 bottom-up earnings per share (EPS) estimates for the Index fell by just 2.2% between December 31, 2023, and February 28, 2024. For comparison, over the past twenty years (80 quarters), the Index’s bottom-up EPS estimates have been reduced by an average of 2.9% during the first two months of each quarter.

Takeaway

While earnings beats are generally viewed as positive news for the overall market, they may not tell the whole story. As today’s chart reveals, the earnings beat rate for the companies that comprise the S&P 500 Index dipped below its 4-year average in Q4’23. In addition, data from FactSet shows that in aggregate, companies are reporting earnings that are 4.1% above estimates, which is below the 10-year average of 6.7%. That said, the overall blended earnings (combines actual results with estimates for companies yet to report) for the companies in the S&P 500 Index rose by 4.0% on a year-over-year (y-o-y) basis in Q4’23. If that figure holds, it will represent the second consecutive quarter of y-o-y earnings increases. As we mentioned last week (click here to read our last post), we view revenue growth as foundational to growth in earnings. While not in today’s chart, the 4Q’23 blended revenue growth rate for the Index stood at 4.2% on 2/29/24. Barring a significant change in revenue growth rates over the coming weeks, this would mark the thirteenth consecutive quarter of revenue growth for the S&P 500 Index.