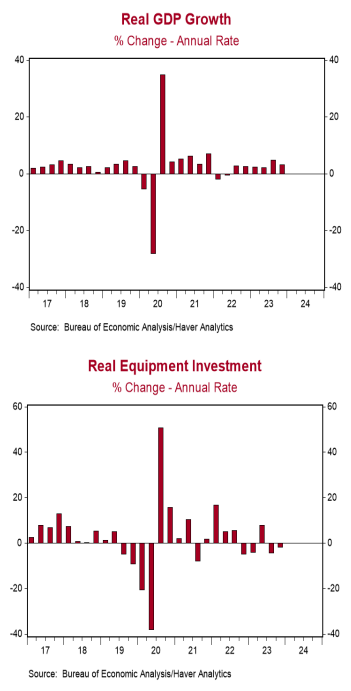

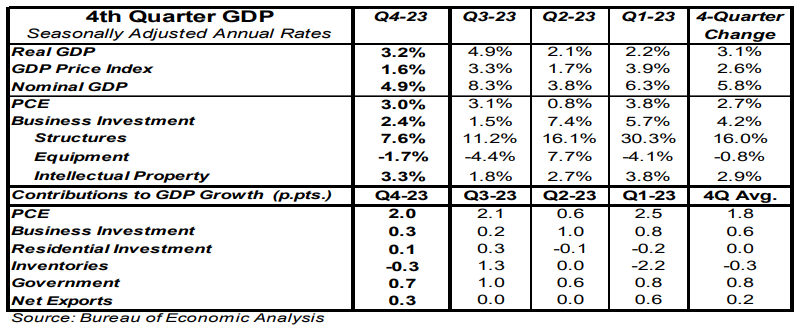

- Real GDP growth in Q4 was revised slightly lower to a 3.2% annual rate from a prior estimate and consensus expected 3.3%.

- Downward revisions to inventories and net exports more than offset upward revisions to government purchases, personal consumption, business investment, and home building.

- Personal consumption, business fixed investment, and home building, combined, rose at a 2.9% annual rate in Q4. We refer to this as “core” GDP.

- The GDP price index was revised higher to a 1.6% annual growth rate from a prior estimate of 1.5%. Nominal GDP growth – real GDP plus inflation – was revised higher to an 4.9% annualized rate from a prior estimate of 4.8%.

Implications: Real GDP was revised slightly lower for the fourth quarter to a 3.2% annual rate from a prior estimate of 3.3%. The downward revision to the overall number was due to lower net exports along with a small change in inventories. These declines offset upward revisions to personal consumption of services, government purchases, home building, and commercial construction. To analyze the growth trends more accurately, we follow "core" GDP, which includes consumer spending, business fixed investment, and home building, while excluding government purchases, inventories, and international trade, which are too volatile for long-term growth. “Core” GDP increased at a respectable 2.9% annual rate in Q4. Regarding monetary policy, today’s inflation news shows price growth continues to slow but the battle is not over. GDP inflation was revised slightly higher to a 1.6% annual rate in Q4 versus a prior estimate of 1.5%, but GDP prices are still up 2.6% from a year ago, above the Fed’s 2.0% target. Meanwhile, nominal GDP (real GDP growth plus inflation) rose at a 4.9% annual rate in Q4 and is up 5.8% from a year ago. In other news from yesterday, the M2 measure of money supply declined 0.2% in January and is down 2.0% from a year ago, and 4.2% lower than the peak in July 2022. Monetary policy operates with a lag, and we are likely to feel the negative economic effects of these declines in the year ahead.