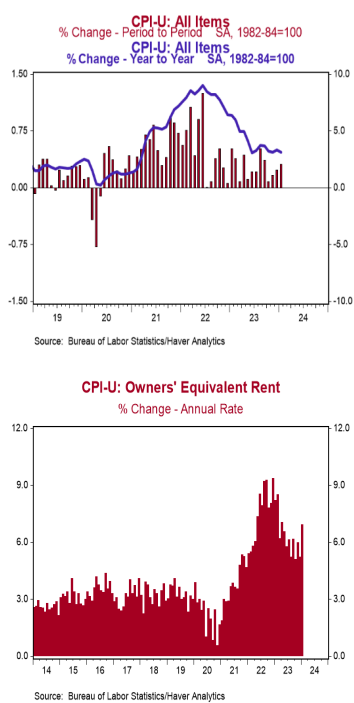

- The Consumer Price Index (CPI) rose 0.3% in January, above the consensus expected +0.2%. The CPI is up 3.1% from a year ago.

- Food prices rose 0.4% in January, while energy prices declined 0.9%. The “core” CPI, which excludes food and energy, rose 0.4% in January, above the consensus expected +0.3%. Core prices are up 3.9% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – rose 0.3% in January and are up 1.5% in the past year. Real average weekly earnings are down 0.1% in the past year.

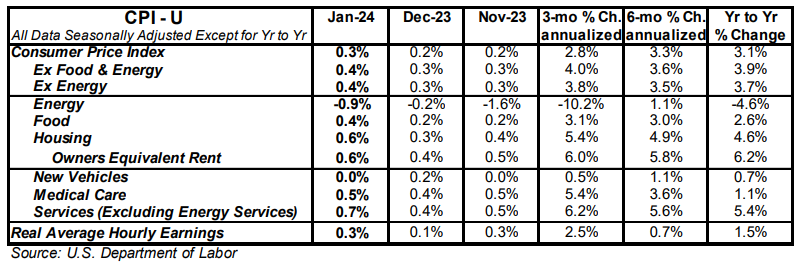

Implications: Inflation accelerated at the start of the year, showing that it is still an important problem and the Federal Reserve should not rush into cutting rates. Yes, the M2 measure of money is down in the past year, but that aggregate may not be directly comparable to history and, even if so, the lags are long and variable. Consumer prices rose 0.3% in January, the most in four months and above the consensus expected 0.2%. In the past year, overall consumer prices are up 3.1%, still a far cry from the Fed’s 2.0% target. Notably, headline inflation was held down in January by the volatile energy sector, where prices declined 0.9% in large part due to a 3.3% drop in gasoline prices. Stripping this category out along with food prices shows that “core” inflation accelerated in January as well, increasing 0.4% – the fastest rate in nine months – while the twelve-month comparison remained stubbornly at 3.9%. Looking at the details, rental inflation – both for actual tenants and the imputed rental value of owner-occupied homes – continue to defy predictions of imminent reversal, rising 0.5% for the month and still running at or above a 5% annualized rate over three-, six-, and twelve-month timeframes. This is important because housing rents make up a third of the overall index and accounted for more than half of the monthly rise in January. But the most troublesome piece of today’s report came from movement in a subset category of prices that the Fed is watching closely – known as the “Super Core” – which excludes food, energy, other goods, and housing rents, and is a useful gauge of inflation in the services sector. That measure jumped 0.8% in January – the biggest increase since April 2022 – when the US was experiencing the height of its inflation scare. In the last twelve months, this measure is up 4.4% and has been accelerating as of late (up at 6.7% and 5.5% annualized rates in the last three and six months, respectively), stoking fear that inflation has become entrenched in the services sector. The spike in Super Core prices in January was largely due to increasing prices for transportation services (+1.0%), medical services (+0.7%), and hotels/motels (+2.4%). Meanwhile, the US economy and labor market continue to chug along. No matter which way you cut it, the Federal Reserve has little reason at this point to start cutting rates anytime soon. How they respond to the incoming economic data in the months ahead could determine whether we repeat the inflationary 1970s.