View from the Observation Deck

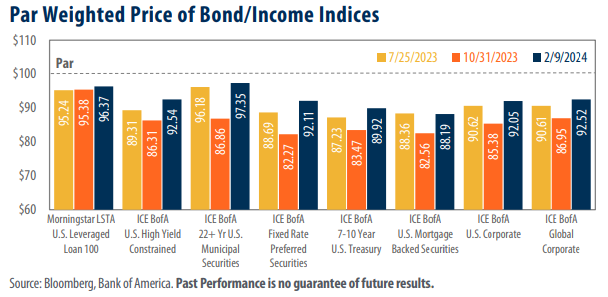

Today’s blog post is intended to provide insight into the movement of bond prices relative to changes in interest rates. For comparative purposes, the dates in the chart are from prior posts we’ve written on this topic.

Valuations for each of the eight bond indices in today’s chart have improved significantly since our last post.

When we last posted on this topic at the beginning of November, the Federal Reserve (“Fed”) had recently announced that interest rates were likely to remain “higher for longer” amidst persistently high inflation. As we see it, the drawdown in bond valuations between our posts in July and November (see chart) reflected the Fed’s sentiment. Up until then, the Fed had announced a total of 11 increases to the federal funds target rate (upper bound) over the previous 19 months, raising the rate from 0.25% where it stood on 3/15/22, to 5.50% as of 11/1/23. That said, the Fed’s outlook changed dramatically since then. In December, just a few short months after its “higher for longer” announcement, the Fed revealed that it anticipated as many as three rate cuts totaling 75 bps in 2024. Bond valuations (which generally move inversely to bond yields) rallied on the news, with the yield on the 10-year Treasury Note plummeting by 82 basis points (bps) between October 19, 2023 (most recent high) and February 9, 2024.

The trailing 12-month rate of change in the Consumer Price Index (CPI) stood at 3.1% as of 1/31/24, down significantly from its most recent peak of 9.1% on 6/30/22, but up from its most recent low of 3.0% on 6/30/23.

While the decrease in the CPI is a welcome relief to bond investors and consumers alike, inflation remains above the Fed’s stated goal of 2.0% as well as its 30-year average of 2.5% (through 1/31/24). Following their policy meeting on January 31, 2024, the Fed voted to keep the federal funds target rate unchanged, marking the fourth consecutive meeting with no changes. Inflation’s re-acceleration, combined with continued strength in the U.S. economy has made predicting the timing of the Fed’s cuts incredibly difficult. At the close of 2023, the federal funds rate futures market was pricing in an 84.3% chance that the Fed would cut rates at its policy meeting in March 2024. As of February 9, 2024, that same metric had plummeted by 65 percentage points to just 19.3%.

Takeaway

Bond valuations have improved dramatically over the past few months. In our view, the recent surge in prices can be attributed to changing expectations regarding the path of the federal funds target rate. In September, the Fed commented that it could keep rates higher for longer to quell persistently high inflation. Then, just a few short months later, the Fed’s sentiment shifted dramatically. In December, the Fed announced that it expected 75 bps of cuts over three meetings in 2024. The fixed income markets surged on the news, with the Bloomberg U.S. Aggregate and Bloomberg Global Aggregate Bond Indices rising by 6.93% and 6.38%, respectively, on a total return basis between October 31, 2023, and February 9, 2024. That said, timing the Fed can prove to be a fruitless endeavor. On December 31, 2023, the federal funds futures market was pricing in an 84.3% change that the Fed would cut rates at its March policy meeting. Stronger than expected economic data and a re-acceleration in the pace of inflation from November to December appear to have stifled these predictions. Expectations of a rate cut in March plummeted to just 19.3% on February 9, 2024, representing a decline of 65 percentage points from where they stood on December 31, 2023.