View from the Observation Deck

Today’s post compares the performance of consumer stocks to the broader market, as measured by the S&P 500 Index, over an extended period. Given that consumer spending has historically accounted for roughly two-thirds of U.S. Gross Domestic Product (GDP), we think the performance of consumer stocks can offer insight into potential trends in the broader economy.

Real consumer discretionary spending rose to $10.9 trillion in 2023, an increase of $1.2 trillion from the $9.7 trillion in real discretionary spending in 2019 (pre-COVID).

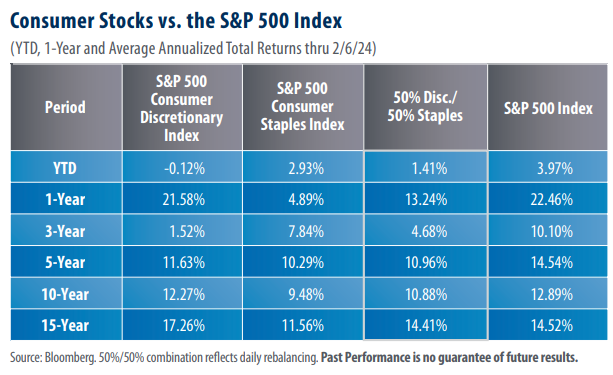

The last time we posted on this topic (click here) we noted that consumer discretionary stocks had outperformed consumer staples as well as the S&P 500 Index by a significant margin on a year-to-date basis. Discretionary stocks held their lead over staples through the remainder of the year, but lagged the S&P 500 Index, which was propelled forward on exuberance surrounding developments in AI (see table). We think the 1-year performance margin between the S&P 500 Consumer Discretionary and Consumer Staples Indices can be explained, in part, by improving net worth among U.S. households. Data from the Federal Reserve Bank of St. Louis revealed that U.S. household net worth stood at $142.4 trillion at the close of Q3’23, up from $110.1 trillion at the end of Q4’19 (pre-COVID). Consumer sentiment has also improved. In December 2023 and January 2024, the University of Michigan’s Index of Consumer Sentiment surged by 14% and 13% on a month-overmonth basis, respectively.

Just how healthy is the U.S. consumer?

While discretionary spending and consumer sentiment have risen substantially, so has U.S. household debt. The Federal Reserve Bank of New York reported that aggregate household debt balances increased by $212 billion in Q4’23, to a record $17.50 trillion. Credit card debt and auto loans rose by $50 billion and $12 billion in the fourth quarter alone, to a record $1.13 trillion, and $1.61 trillion, respectively. Higher loan balances combined with surging interest rates have pressured borrowers. During the quarter, 6.3% of credit card loans were categorized as seriously delinquent (at least 90 days past due). The second quarter of 2011 was the last time serious delinquency rates were higher than present values. Additionally, consumers appear to be saving less. The personal savings rate stood at 3.7% in December, down from 4.1% in February 2022, the month before the Federal Reserve began raising interest rates.

Takeaway

From our perspective, the S&P 500 Consumer Discretionary Index has benefitted from a surge in U.S. household net worth and lower inflationary pressures, the combination of which has led to a spike in consumer sentiment. The trailing 12-month rate on the consumer price index stood at 3.4% on December 31, 2023, marking a stunning retreat from when it stood at 9.1% on June 30, 2022. This slowdown in the pace of rising prices has been a welcome relief to many Americans who, stretched thin by rising interest rates, plummeting savings, and record levels of credit card debt, are a significant driver of economic growth. Should the consumer remain healthy, the possibility of the U.S. experiencing a notable recession could be diminished. Stay tuned!