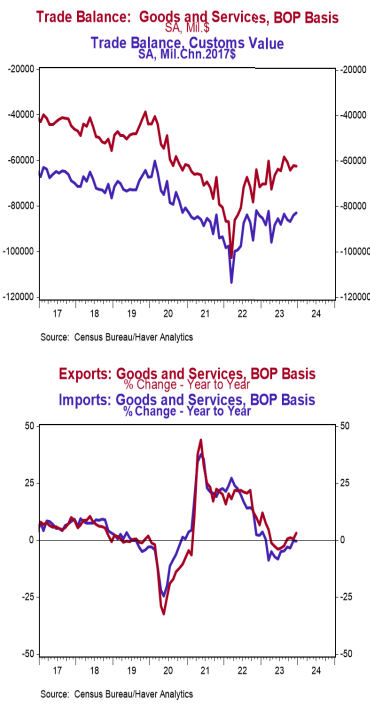

- The trade deficit in goods and services came in at $62.2 billion in December, slightly larger than the consensus expected $62.0 billion.

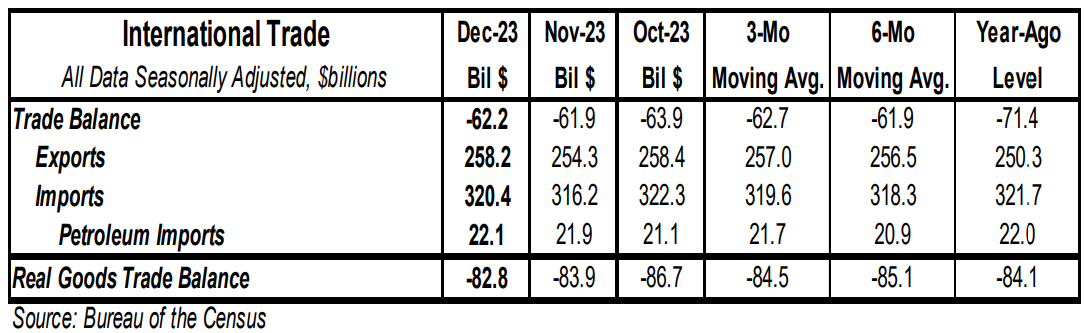

- Exports rose by $3.9 billion, led by nonmonetary gold, other petroleum products, and crude oil. Imports rose by $4.2 billion, led by pharmaceuticals and cellphones & other household goods.

- In the last year, exports are up 3.2% while imports are down 0.4%.

- Compared to a year ago, the monthly trade deficit is $9.2 billion smaller; after adjusting for inflation, the “real” trade deficit in goods is $1.3 billion smaller than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications: The trade deficit in goods and services grew to $62.2 billion in December as imports rose faster than exports. However, we prefer to focus on the total volume of trade, imports plus exports, as it shows the extent of business and consumer interaction across the US border. This measure rebounded in December after pulling back significantly in November, rising by $8.2 billion. Total trade volume is up a slight 1.2% from a year ago with exports up 3.2% versus a year ago, while imports are down 0.4%, consistent with our forecast that the US is headed toward a recession. And while a recent surge in the federal budget deficit might have helped the US economy avoid recession in the short-term, this kind of artificial support can’t last. Notably, there is a major shift going on in the pattern of US trade. For all of 2023, imports from China were down 20.3% versus 2022. China used to be the top exporter to the US. Now the top spot is held by Mexico where exports from Mexico were up 4.6% in 2023 versus 2022. China has fallen to number two with Canada nipping at its heels. Meanwhile, daily freight fell rapidly in 2023, and was back down to pre-COVID levels, or lower, as demand for shipping stabilized. This was confirmed by the New York Fed’s Global Supply Chain Pressure Index in December, with the index moving back into negative territory, but it sits just 0.15 standard deviations below the index’s historical average. For some perspective two years ago in the month of December the index sat 4.34 standard deviations above the index’s historical average. Expect some temporary volatility into the new year though as Yemen’s Houthi rebels continue to deter container ships from transiting the Red Sea and Bab-el-Mandeb Strait, temporarily adding significantly to shipping costs. Also in today’s report, the dollar value of US petroleum exports exceeded imports once again. This marks the 22nd consecutive month of the US being a net exporter of petroleum products.