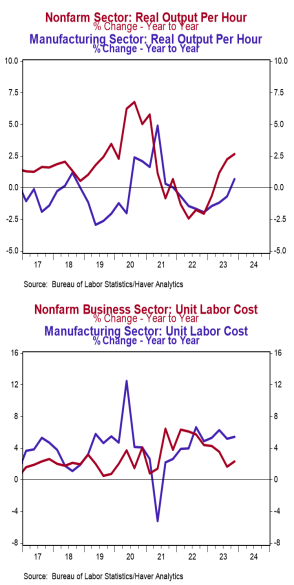

- Nonfarm productivity (output per hour) increased 3.2% at an annual rate in the fourth quarter, beating the consensus expected gain of 2.5%. Nonfarm productivity is up 2.7% versus last year.

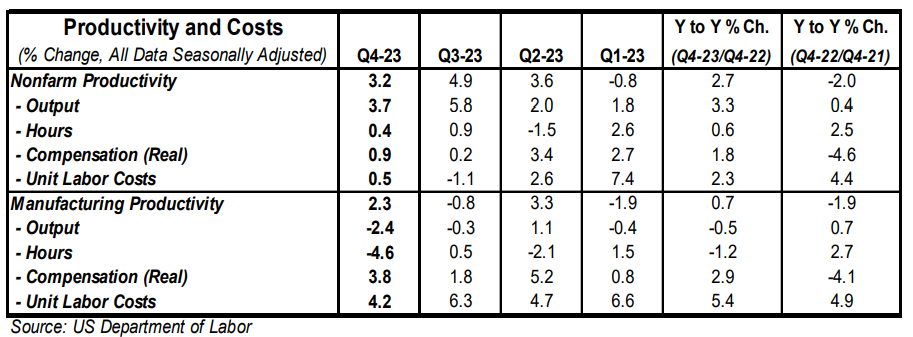

- Real (inflation-adjusted) compensation per hour in the nonfarm sector rose at a 0.9% annual rate in Q4 and is up 1.8% versus a year ago. Unit labor costs rose at a 0.5% annual rate in Q4 and are up 2.3% versus a year ago.

- In the manufacturing sector, productivity rose at a 2.3% annual rate in Q4. Real compensation per hour increased at a 3.8% annual rate in the manufacturing sector, while unit labor costs rose at a 4.2% annual rate.

Implications: Nonfarm productivity rose at a 3.2% annualized rate in the fourth quarter, as both output and hours rose, but output rose at a faster pace, leading to more output per hour. Productivity rose 2.7% in 2023, offsetting the drop of 2.0% in 2022. Since the peak in the business cycle right before COVID, productivity is up at a 1.6% annual rate, very close to the 1.5% average of the past twenty years. Even though inflation is still elevated, “real” (inflation-adjusted) compensation per hour grew at a 0.9% annualized rate in Q4 and is up 1.8% in the past year after steep declines in 2021-22. Since the pre-COVID peak, real compensation is up at a 0.6% annual rate, very close to the 0.7% pace of the past twenty years. On the manufacturing front, productivity rose at a 2.3% annualized rate in Q4, but not for great reasons as both output and hours declined, but hours fell faster than output meaning output per hour rose. Most of the manufacturing data we have received over the past year have shown that manufacturing continues to decelerate, except where government subsidies have temporarily boosted activity. Expect hours and output in this sector to continue to weaken in the quarters ahead. In other news this morning, on the employment front, initial jobless claims rose 9,000 last week to 225,000. Meanwhile, continuing claims increased 70,000 to 1.898 million. Also on the labor front, ADP’s measure of private payrolls increased 107,000 in December versus a consensus expected 150,000. We’re estimating tomorrow’s government report will show a nonfarm payroll gain of 173,000 with the unemployment rate remaining at 3.7%. In recent housing news, home prices are showing consistent gains after a drop in late 2022. The national Case-Shiller index rose 0.2% in November while the FHFA index rose 0.3%.