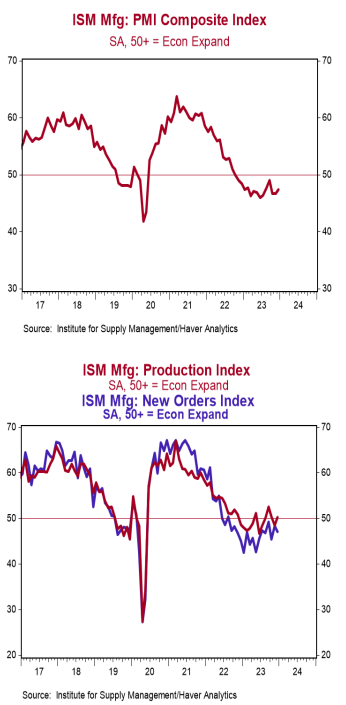

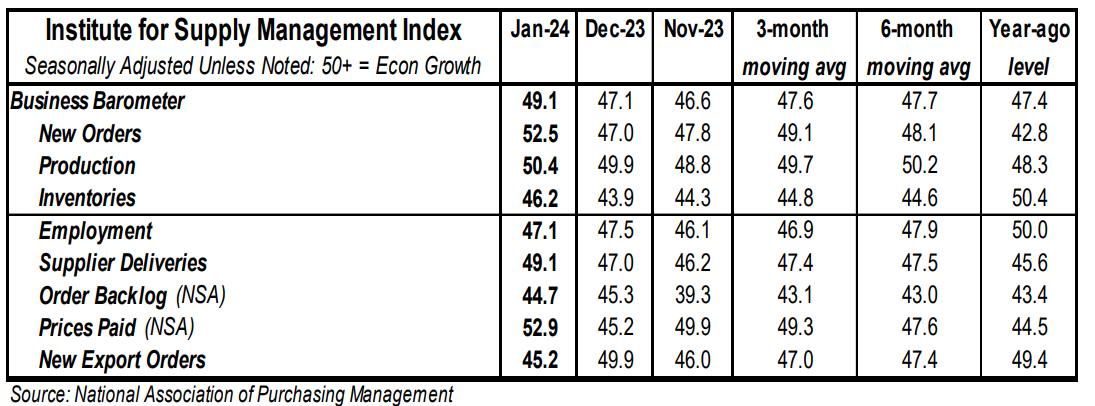

- The ISM Manufacturing Index increased to 49.1 in January, beating the consensus expected 47.2. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mostly higher in January. The new orders index rose to 52.5 from 47.0 in December and the production index increased to 50.4 from 49.9. The employment index declined to 47.1 from 47.5 in December, while the supplier deliveries index increased to 49.1 from 47.0.

- The prices paid index rose to 52.9 in January from 45.2 in December.

Implications: Activity in the US manufacturing sector contracted for the fifteenth consecutive month in January, but the details of the report show some signs of improvement. On the surface, just four out of eighteen industries reported growth in January. Despite narrow growth, survey comments were cautiously positive, citing a good start to the year, but with a note of caution as the US economic outlook continues to weigh on activity. Perhaps the best news comes from the new orders index, which moved into expansion territory for the first time in seventeen months. Meanwhile, output remained stable as the production index ticked up to 50.4. Despite signs of improvement, demand remains soft. And with output skating along, the backlog of orders continues to contract, now for sixteen consecutive months. Something has to give… either new orders pick up, or production falls. We expect the latter. When looking at the big picture, during COVID, a combination of shelter-in-place orders and extra compensation from the government (in the form of stimulus checks and abnormally large unemployment benefits) artificially boosted goods-related activity. Then the economy reopened, and consumers began shifting their spending preferences back to a more normal mix, away from goods and back to services. The ISM index peaked in March 2021 (the last month federal stimulus checks were sent out) and has been on a downward trajectory since. We continue to believe a recession is lurking in the year ahead and the manufacturing sector is likely to lead the way. Case in point, hiring activity in the manufacturing sector contracted for the fourth consecutive month as companies continued reducing headcounts in January with significant layoff activity, while quit rates remained at twelve-month lows. We believe investors should remain cautious as the monetary and fiscal stimulus that made COVID lockdowns seem like a bump in the economic road wear off. In other news this morning, construction spending increased 0.9% in December, driven by large increases in highway and street projects as well as homebuilding.