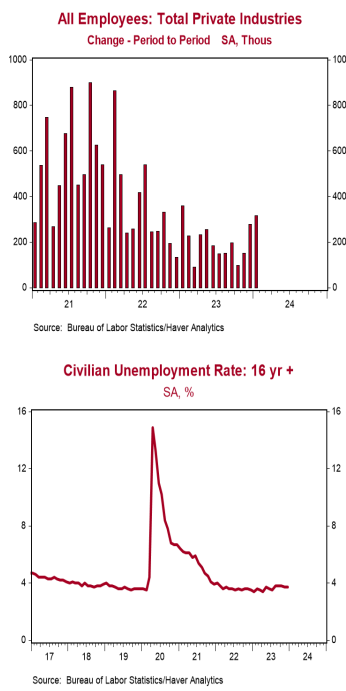

- Nonfarm payrolls increased 353,000 in January, beating the consensus expected 185,000. Payroll gains for November and December were revised up by a total of 126,000, bringing the net gain, including revisions, to 479,000.

- Private sector payrolls rose 317,000 in January and were revised up by 130,000 in prior months. The largest increases in January were education & health services (+112,000), professional & business services (74,000, including temps), and retail (+45,000). Government rose 36,000 while manufacturing increased 23,000.

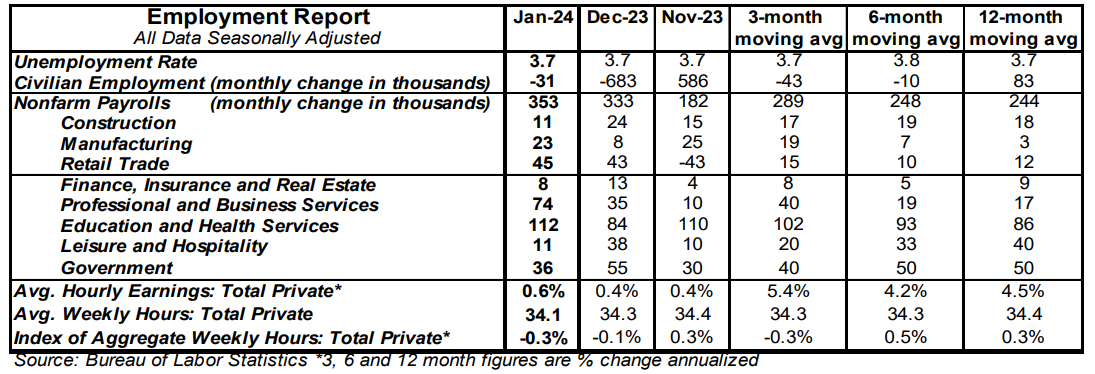

- The unemployment rate remained at 3.7%.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.6% in January and are up 4.5% versus a year ago. Aggregate hours declined 0.3% in January but are up 0.3% from a year ago.

Implications: A March rate cut is as dead as a doornail, but the job market isn’t quite as strong as today’s headlines. First, the good news. Nonfarm payrolls increased 353,000 in January, the largest gain in a year, and well higher than the forecast from any economics group on Bloomberg. In addition, gains in November and December were revised upward by 126,000. We like to follow payrolls excluding government (because it's not the private sector), education & health services (because it rises for structural and demographic reasons, and usually doesn’t decline even in recession years), and leisure & hospitality (which is still recovering from COVID Lockdowns). That “core” measure of payrolls rose 194,000 in January, which is the best month since mid-2022. Although civilian employment, an alternative measure of jobs that includes small-business start-ups, declined by 31,000, this is the month every year when the Labor Department updates its estimates of the US population, which affects the employment numbers and makes them not directly comparable to prior months. Meanwhile, unemployment remained at a low 3.7%. What will surely get the Federal Reserve’s attention is a 0.6% rise in average hourly earnings, which are now up 4.5% versus a year ago, not much different than the 4.6% increase in the year ending January 2023. If the Fed wants 2.0% inflation, given long-term productivity trends, they probably want to see wages growing closer to 3.5% per year, not 4.5%. But here’s the bad news. In spite of the solid payroll numbers, total hours worked in the private sector declined 0.3% in January and are up a meager 0.3% versus a year ago. The drop in hours in January is the equivalent of losing 465,000 jobs. Average weekly hours haven’t been this low since March 2020, with the onset of COVID. What this means is that businesses have added lots of jobs in the past year and are paying their workers more per hour, but they are finding less for them to do. In turn, this is consistent with our view that companies have gotten out over their skis in terms of hiring, a recipe for layoffs later in 2024. Total payrolls are up 1.9% in the past year, a pace that would be normal in the middle of an economic expansion when the unemployment rate (and available workers) is much higher than it is today. A weaker job market is heading our way. In other recent news, Americans bought cars and light trucks at a 15.0 million annual rate in January, down 6.9% from December and 0.7% lower than a year ago. This means that retail sales are likely to have fallen in January, as well.