View from the Observation Deck

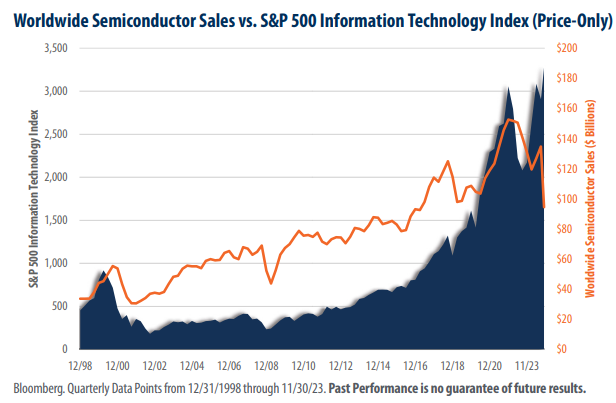

Tracking the direction of worldwide semiconductor sales can provide investors with additional insight into the potential demand for tech-oriented products and the overall climate for technology stocks, in our opinion. As evidenced by recent developments in artificial intelligence (AI) and robotics, as well as the vast market for smartphones, tablets, and wearables, we continue to find creative and innovative ways to integrate semiconductors into our everyday lives.

Semiconductor sales appear to lag fluctuations in the valuations of technology stocks.

Several of the more notable examples in today’s chart, which goes back to 12/31/1998, occurred after the 1999 Dot-com bubble, the “great recession” of 2008, and the decline from semiconductors’ peak sales in 2022. In our last post on this topic (click here to view it), we wrote that the divergent trend between global semiconductor sales and the performance of the S&P 500 Technology Index appeared to be an anomaly. Since that post, global semiconductor sales have improved but have yet to recapture their peak which was set in 2022. November 2023 marked the first month of year-over-year (y-o-y) semiconductor sales growth since August 2022. Amidst unprecedented demand, the Semiconductor Industry Association (SIA) reported that worldwide semiconductor sales surged by 26.2% to settle at a record $555.9 billion in 2021. In 2022, sales rose to another record of $574.1 billion, but had begun to stagnate in the second half of the year. Hobbled by declining demand, the continued chip shortage, and high inflation, semiconductor sales suffered y-o-y declines each month from August 2022 through October 2023, falling by as much as 21.6% on a y-o-y basis in April 2023. As of November 2023 (most recent data), the World Semiconductor Trade Statistics (WSTS) organization forecast that the global semiconductor market would contract by 9.4% in 2023. That said, November’s sales data showed significant promise, with semiconductor sales rising by 5.3% on a y-o-y basis.

With a total return of 57.84%, technology stocks were the top-performing sector in 2023.

Promising developments in AI, an easing in the global chip shortage, and expectations that the federal reserve (“Fed”) could cut interest rates as early as March 2024 propelled the S&P 500 Information Technology Index to the top of the list in terms of total return through in 2023. In our view, these factors remain in play today, and could be among the reasons why, despite stagnating semiconductor sales, technology stocks outperformed their peers in 2023.

Takeaway

It is nearly impossible to discuss semiconductors and technology stocks without mentioning developments in AI, and

rightly so. One forecast suggests the global AI market could grow to nearly $600 billion by 2026 and $1.8 trillion by 2030,

according to Ryan Issakainen, ETF Strategist at First Trust Portfolios L.P. These growth projections, coupled with expectations

that the Fed could cut interest rates in the first half of 2024, led to an unprecedented surge in the S&P 500 Information

Technology Index, which rose by 57.84% on a total return basis in 2023. That growth has continued in 2024, with the S&P

500 Technology Index boasting a total return of 5.38% year-to-date through 1/22/24. While the valuations of technology

companies are spiking, global semiconductor sales remain below their all-time high set in 2022. With the chip shortage

behind us, and increased demand due to the compute power required for AI, global semiconductor sales are expected

to recover in the coming year. In November 2023 (most recent data), the WSTS estimated that the global semiconductor

market will grow by 13.1% in 2024.