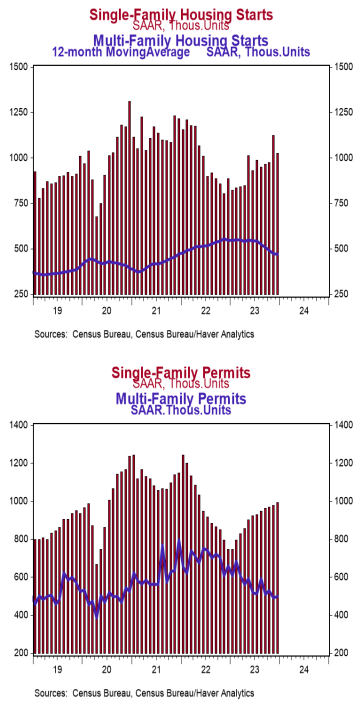

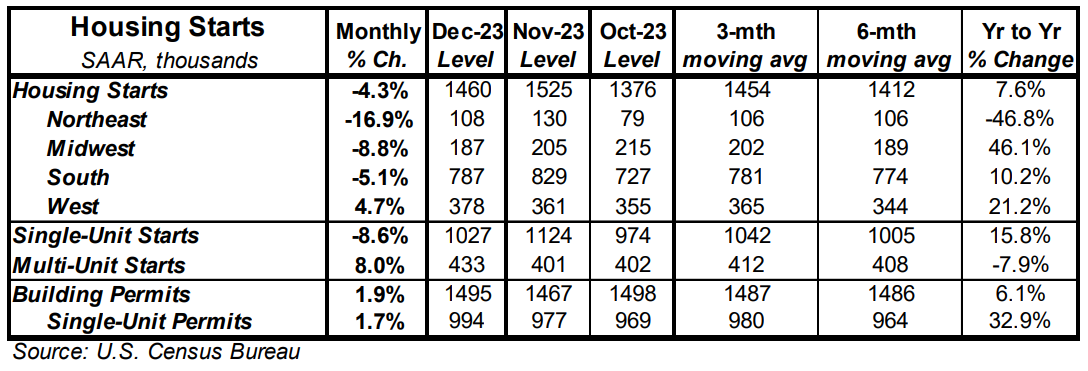

- Housing starts declined 4.3% in December to a 1.460 million annual rate, beating the consensus expected 1.425 million. Starts are up 7.6% versus a year ago.

- The drop in December was entirely due to single-family starts. Multi-unit starts rose in December. In the past year, single-family starts are up 15.8% while multi-unit starts are down 7.9%.

- Starts in December fell in the South, Northeast, and Midwest, but rose in the West.

- New building permits increased 1.9% in December to a 1.495 million annual rate, above the consensus expected 1.477 million. Compared to a year ago, permits for single-family homes are up 32.9% while permits for multi-unit homes are down 24.2%.

Implications: Housing starts took a breather in December following a surge in November. While the data have been choppy, it seems that developers may have finally found their footing as we closed out the year in what had been a challenging environment for sales. This likely has to do with the recent move in mortgage rates, driven by the widely held belief that the Federal Reserve will cut short term interest rates multiple times in 2024. While 30-year mortgage rates remain right around 7%, they have been on a downward trajectory since peaking above 8% at the end of October. We expect mortgage rates to continue trending downward in 2024, providing a tailwind for activity. Looking at the details of today’s report, housing starts declined 4.3% in December, yet still beat consensus expectations. Building permits also beat consensus expectations, rising 1.9% to a solid 1.495 million annual rate. The gain was due to permits for both single-family and multi-unit homes. While multi-unit permits have been trending down over the past year, permits for single-family homes have increased in each of the last eleven months. Meanwhile, housing completions surged 8.7% in December to a 1.574 million annual rate. In 2023, an estimated 1.452 million housing units were completed, 4.5% above the 2022 figure of 1.391 million, but still below what we need to keep up with regular population growth and scrappage of old homes. In the past year, the number of single-family starts is up 15.8% while multi-unit starts are down 7.9%. This huge gap in the data is due to the unprecedented nature of the last three years since COVID began. While we don’t see housing as a major driver of economic growth in the near term, recent numbers are certainly not what you’d expect to see if there was a severe housing bust like the 2000s on the way, either. In employment news this morning, initial claims for jobless benefits fell 16,000 last week to 187,000. Continuing claims declined 26,000 to 1.806 million. These figures are consistent with continued job growth in January. In manufacturing news this morning, the Philadelphia Fed Index, a measure of factory sentiment in that region, rose to -10.6 in January from -12.8 in December, still signaling sluggishness in the factory sector.