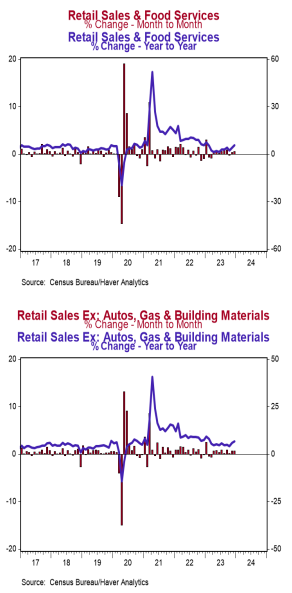

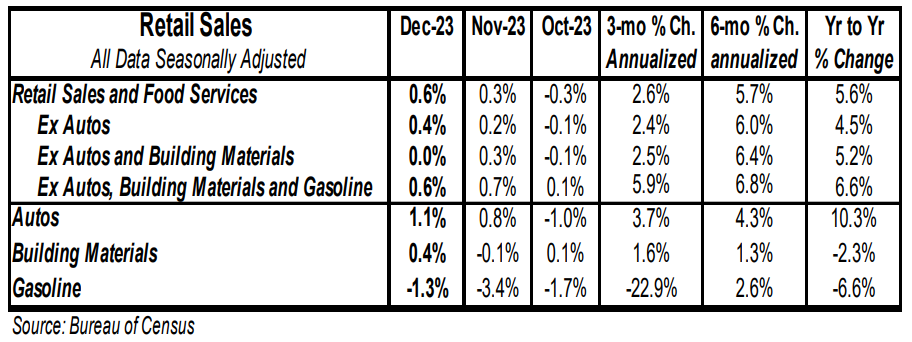

- Retail sales rose 0.6% in December, beating the consensus expected gain of 0.4%. Retail sales are up 5.6% versus a year ago.

- Sales excluding autos increased 0.4% in December, beating the consensus expected gain of 0.2%. These sales are up 4.5% in the past year.

- The largest increases in December were for non-store retailers (internet & mail order), autos, and general merchandise stores. The largest decline was for gas stations.

- Sales excluding autos, building materials, and gas rose 0.6% in December and were up 0.7% including revisions to prior months. These sales were up at a 5.8% annual rate in Q4 versus the Q3 average.

Implications: Retail sales beat expectations in December, rising 0.6% for the month, while nine of the thirteen major categories moved upward. The gains in December were led by sales at non-store retailers, which rose 1.5% for the month and are up 9.7% in the past year, followed by sales for autos (+1.1%), and at general merchandise stores (+1.3%). The largest decline was once again at gas stations, which is not a bad thing as prices at the pump have come down significantly since earlier this Fall. “Core” sales, which exclude volatile categories such as autos, building materials, and gas stations – crucial for estimating GDP – increased 0.6% in December and were revised slightly higher for previous months. These sales were up at a 5.8% annual rate in Q4 versus the Q3 average. Plugging today’s data on retail sales and other reports into our models suggests real GDP grew at about a 2.0% annual rate in the fourth quarter. The problem remains that one of the key drivers of overall spending is inflation. Yes, retail sales are at record highs unadjusted for inflation, but in “real” (inflation-adjusted) terms, they have been stagnant. Real retail sales peaked back in April 2022 and have since declined by 1.9% from that peak. It has been forty years since the US had an inflation problem, so it is important to remember that it can distort data. Our view remains that the tightening in monetary policy since last year will eventually deliver a recession. Expect more deterioration in real retail sales into 2024 as tighter credit conditions along with higher borrowing costs take their toll. In other news this morning, import prices were unchanged in December while export prices fell by 0.9%. In the past year, import prices are down 1.6% while export prices are down 3.2%, a sign of the tightening of monetary policy versus a year ago.