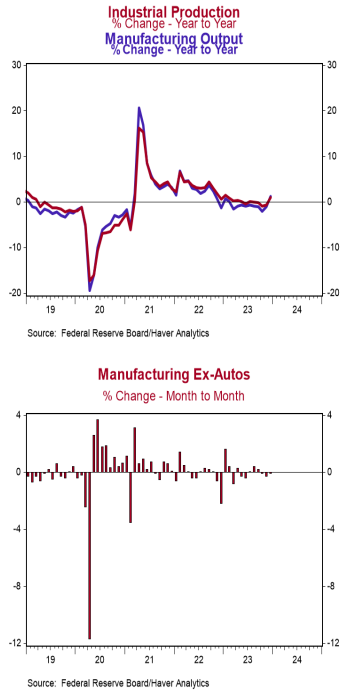

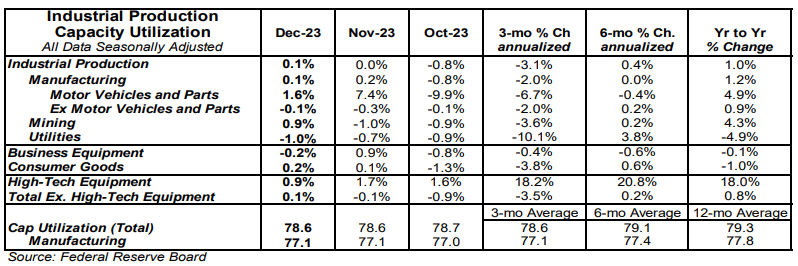

- Industrial production increased 0.1% in December (-0.2% including revisions to prior months) versus a consensus expectation of -0.1%. Utilities output declined 1.0% in December, while mining increased 0.9%.

- Manufacturing, which excludes mining/utilities, increased 0.1% in December (-0.1% including revisions to prior months). Auto production rose 1.6%, while non-auto manufacturing declined 0.1%. Auto production is up 4.9% in the past year, while non-auto manufacturing is up 0.9%.

- The production of high-tech equipment rose 0.9% in December and is up 18.0% versus a year ago.

- Overall capacity utilization remained unchanged at 78.6% in December. Manufacturing capacity utilization remained unchanged at 77.1% in December.

Implications: There wasn’t much to get excited about in this morning’s report on industrial production. The headline index rose a modest 0.1% in December and is now up 1.0% from a year ago. However, including downward revisions to data in prior months overall production fell 0.2% in December. Looking at the details, the manufacturing sector was a source of relative strength, posting a gain of 0.1%. But that was driven entirely by the volatile auto sector, where activity jumped 1.6% (likely the result of striking workers continuing to get back to work). Meanwhile, non-auto manufacturing, which we think of as a “core” version of industrial production, declined 0.1%. The brightest manufacturing news in the report was that the production of high-tech equipment rose 0.9% in December and is up 18.0% in the past year, by far the strongest growth of any major category. Further, that growth has been accelerating recently, up at an even faster 20.8% annualized rate in the past six months. This likely reflects investment in AI as well as the reshoring of semiconductor production, which remains temporarily strong due to the CHIPS Act, despite broader weakness in the industrial sector. The mining sector was also a bright spot in December, with activity rising 0.9%. This was the first increase in three months and was driven by broad-based gains in oil and gas extraction, mineral extraction, and the drilling of new wells. Finally, the utilities sector (which is volatile and largely dependent on weather), posted a decline of 1.0% in December. In other news this morning, the NAHB Housing Index, a measure of homebuilder sentiment, rose to 44 in January from 37 in December. This is the second gain in a row and coincides with the recent moderation in mortgage rates as markets begin to anticipate rate cuts from the Federal Reserve in 2024. That said, a reading below 50 signals that a greater number of builders view conditions as poor versus good.