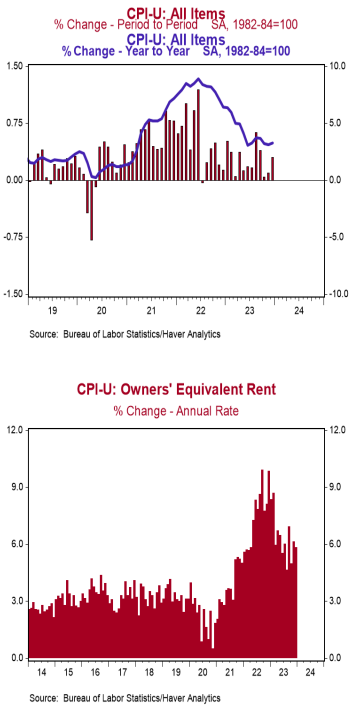

- The Consumer Price Index (CPI) rose 0.3% in December, above the consensus expected +0.2%. The CPI is up 3.4% from a year ago.

- Energy prices rose 0.4% in December, while food prices increased 0.2%. The “core” CPI, which excludes food and energy, rose 0.3% in December, matching consensus expectations. Core prices are up 3.9% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – rose 0.2% in December and are up 0.8% in the past year. Real average weekly earnings are up 0.5% in the past year.

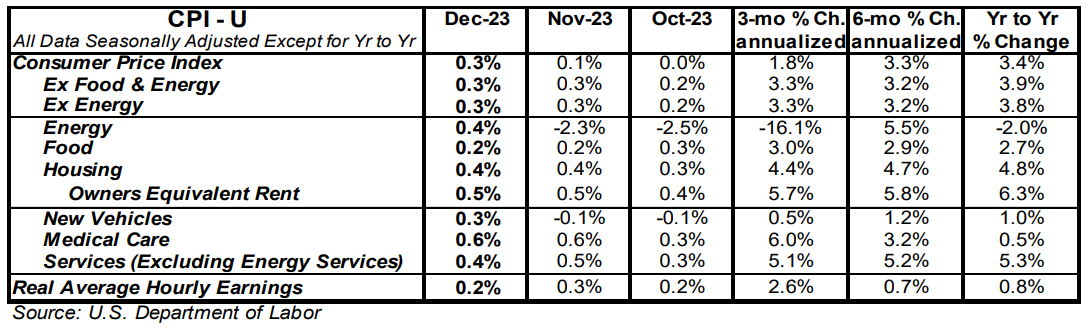

Implications: Inflation accelerated to close out 2023, challenging the belief amongst many that the great inflation scare is in the rearview mirror. Consumer prices came in above consensus expectations in December, rising 0.3% for the month, while the twelve-month comparison rose to a three-month high of 3.4%. Yes, that is leaps and bounds better than the 6.5% reading in the year ending December 2022, but still a far way off from the Fed’s 2.0% long-term target. Stripping out the volatile food and energy components to get “core” prices does not make the inflation picture look any better. Core prices rose 0.3% in December and are up 3.9% from a year ago, almost double the Fed’s so-called target rate. Taking a deeper look under the inflation hood reveals more concern. Rental inflation – both for actual tenants and the imputed rental value of owner-occupied homes – continues to run hot, up 0.5% for the month and running at or above a 6% annualized rate over three-, six-, and twelve-month timeframes. This is important because housing rents make up a third of the overall index. Meanwhile, a subset category of prices that the Fed is watching closely – known as the “Super Core” – which excludes food, energy, other goods, and housing rents, jumped 0.4% for the second month in a row. This measure is up 3.9% in the last twelve months and has showed no signs of slowing; up at 4.3% and 4.5% annualized rates in the last three and six months, respectively. Although inflation trended lower in 2023, it is still not where the Fed has always said it wants it to be. With interest rates above inflation across the yield curve and the M2 measure of the money supply down 4.3% from the peak in July 2022, money seems to be tight enough to bring inflation down. But a monetary policy tight enough to bring inflation down is also tight enough to induce an eventual recession. How the Federal Reserve responds to that economic weakness could determine whether we repeat the inflationary 1970s. In employment news this morning, initial claims for jobless benefits fell 1,000 last week to 202,000. Continuing claims declined 34,000 to 1.834 million. These figures are consistent with moderate job growth in January.