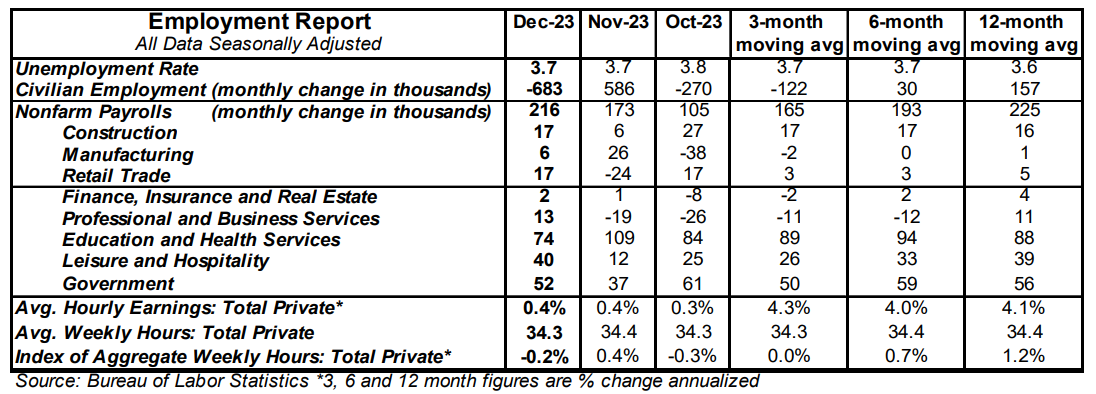

- Nonfarm payrolls increased 216,000 in December, beating the consensus expected 175,000. Payroll gains for October and November were revised down by a total of 71,000, bringing the net gain, including revisions, to 145,000.

- Private sector payrolls rose 164,000 in December but were revised down by 55,000 in prior months. The largest increases in December were education & health services (+74,000), government (+52,000), and leisure & hospitality (+40,000). Manufacturing rose 6,000.

- The unemployment rate remained at 3.7%.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.4% in December and are up 4.1% versus a year ago. Aggregate hours declined 0.2% in December but are up 1.2% from a year ago.

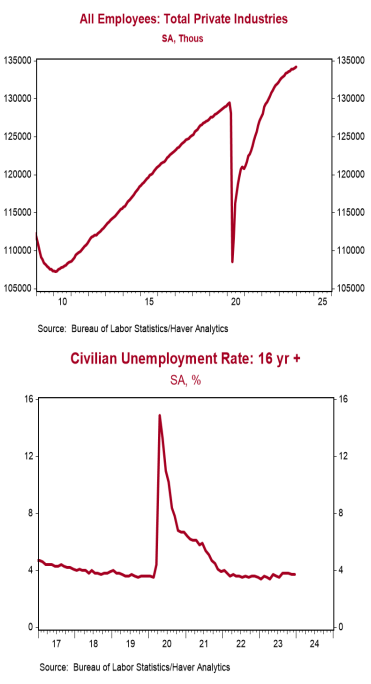

Implications: Not as strong as the headline, but also hard for the Federal Reserve to start cutting rates soon. Nonfarm payrolls rose 216,000 in December, beating the consensus expected 175,000. So far, so good. However, revisions to prior months subtracted 71,000 from payrolls, bringing the net gain to 145,000. Private payrolls rose 164,000 in December but were up a moderate 109,000 including downward revisions to prior months. In the past year, payrolls are up about 2.7 million. But civilian employment, an alternative measure of jobs that includes small-business start-ups, is up a smaller 1.9 million. That kind of gap, where the payroll measure of jobs is growing notably faster than civilian employment is sometimes a harbinger of recessions. Meanwhile, the average workweek in the private sector ticked down to 34.3 hours in December from 34.4 in November. As a result, total private hours worked declined 0.2% in December, which is obviously not a sign of strength. For 2023 as a whole, payrolls rose a solid 225,000 per month. We like to follow payrolls excluding government (because it's not the private sector), education & health services (because it rises for structural and demographic reasons, and usually doesn’t decline even in recession years), and leisure & hospitality (which is still recovering from COVID Lockdowns). In the last seven months, this “core” measure of payrolls was up only 3,000 per month, a pace that in the past has usually been associated with recessions. Notably, the worst two sectors for payrolls in December were temps (-33,000) and couriers & messengers (-32,000). Expect more sectors with negative numbers to appear in the next few months. However, that doesn’t mean the Federal Reserve will start cutting short-term interest rates at the next meeting on January 31. Average hourly wages rose 0.4% in December and are up 4.1% from a year ago, higher than the Fed thinks is consistent with its 2.0% inflation goal. The M2 measure of the money supply is down versus a year ago and the yield curve is inverted. We continue to think this is a recipe for risk aversion among businesses. The labor market is often a lagging indicator and we expect the economy (real output) to weaken before employers stop hiring, on net. Expect continued job growth for the next few months, but a weakening and recessionary labor market is heading our way.