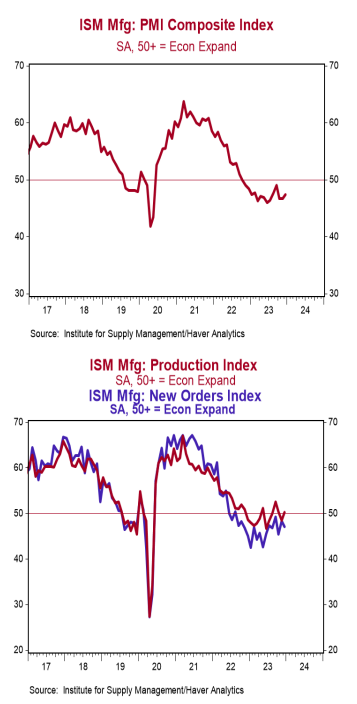

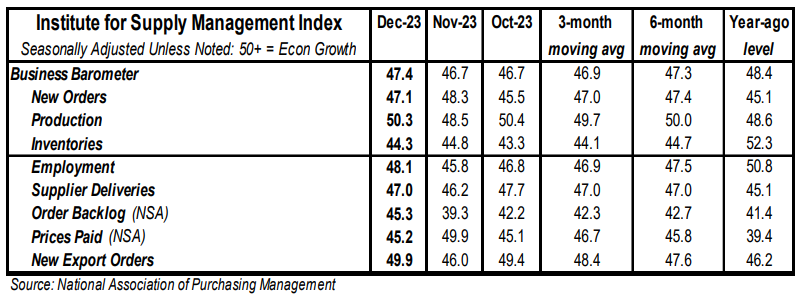

- The ISM Manufacturing Index increased to 47.4 in December, beating the consensus expected 47.1. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mixed in December. The production index rose to 50.3 from 48.5 in November, while the new orders index declined to 47.1 from 48.3. The employment index rose to 48.1 from 45.8 in November and the supplier deliveries index increased to 47.0 from 46.2.

- The prices paid index fell to 45.2 in December from 49.9 in November.

Implications: The December ISM report tied a bow on what was a lousy year for the US manufacturing sector, as activity contracted for the fourteenth consecutive month, the longest streak since the aftermath of the 2000-2001 recession. Looking at the big picture, during COVID, a combination of shelter-in-place orders and extra compensation from the government (in the form of stimulus checks and abnormally large unemployment benefits) artificially boosted goods-related activity. Then the economy reopened, and consumers began shifting their spending preferences back to a more normal mix, away from goods and back to services. The ISM index peaked in March 2021 (the last month federal stimulus checks were sent out) and has been on a downward trajectory since. We continue to believe a recession is lurking in the year ahead and the details of today’s report suggest the goods sector of the economy is likely to lead the way. On the surface level, just one out of eighteen major industries (Primary Metals) reported growth in December. Despite sluggish activity, survey comments were surprisingly upbeat, largely due to optimism around the Federal Reserve effectively declaring “mission accomplished” at their meetings in December, which they believe will encourage more companies to resume spending on capital investments. Lack of new investment can be most easily seen in the index for new orders, which fell further into contraction territory in December and has sat below 50 for sixteen consecutive months, the longest streak since the early 1980s. Meanwhile, the production index continued to come in choppy and has bounced around 50 for most of 2023. With new orders down, but production skating along, the backlog of orders continues to contract, now for fifteen consecutive months. Something has to give… Either new orders pick up, or production falls. We expect the latter. Finally, on the inflation front, the prices index fell in December and has been sitting in contraction territory for the last eight months, showing that tighter money since 2022 is gaining some traction against inflation. In other recent news, construction spending increased 0.4% in November. The gain was driven by a large increase in home building and manufacturing projects, which more than offset smaller declines across most other categories.