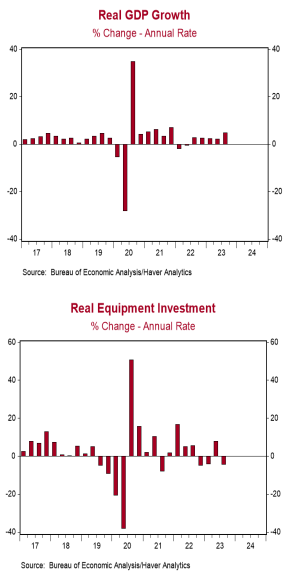

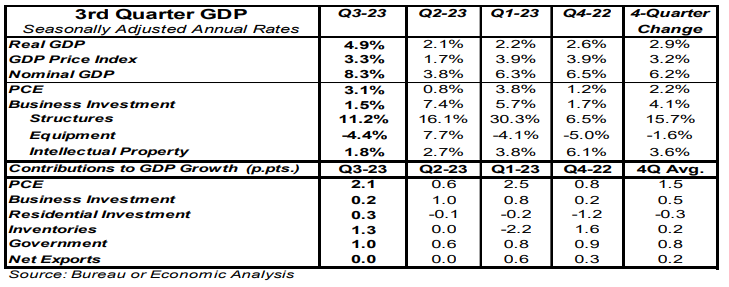

- Real GDP growth in Q3 was revised lower to a 4.9% annual rate, coming in below the consensus expected 5.2%.

- Downward revisions to consumer spending and inventories more than offset small upward revisions to government purchases, net exports, home building, and business investment.

- The largest positive contributions to the real GDP growth rate in Q3 were consumer spending, inventories, and government purchases. The weakest component was net exports.

- The GDP price index was revised lower to a 3.3% annual growth rate from a previous reading of 3.6%. Nominal GDP growth – real GDP plus inflation – was revised lower to an 8.3% annualized rate from a prior estimate of 8.9%.

Implications: The final reading for real GDP growth in the third quarter came in below consensus expectations but still at a robust 4.9% annual rate. A downward revision to consumer spending, mainly in services, along with a slower pace of inventory accumulation, more than offset small upward revisions to government purchases, net exports, home building, and business investment. Today we also got our second look at economy-wide corporate profits for Q3, which were revised slightly higher, now up 3.4% from Q2 verses the 3.3% gain reported last month, and down 0.6% from a year ago versus the -0.7% reported a month ago. The government includes Federal Reserve profits in this data, and the Fed is making losses. So, we follow profits excluding those earned (or lost) by the Fed, which are still up 5.5% from a year ago. Moving forward, we expect a further slowdown in corporate profits as the economy continues to re-normalize after the massive fiscal and monetary stimulus of 2020-21. In turn, this will be a headwind for equities. In addition to corporate profits, we also got revisions for Real Gross Domestic Income, an alternative to GDP that is just as accurate. Real GDI was unrevised, increasing at a 1.5% annual rate in Q3 but is down 0.1% versus a year ago, consistent with underlying economic weakness. These are figures that are normally seen in and around recessions. Regarding monetary policy, inflation continues to move lower. GDP inflation was revised down to a still elevated 3.3% annual rate in Q3 versus a prior estimate of 3.6%. GDP prices are up 3.2% from a year ago, still well away from the Fed’s 2.0% target. Meanwhile, nominal GDP (real GDP growth plus inflation) rose at an 8.3% annual rate in Q3 and is up 6.2% from a year ago. In employment news this morning, initial claims for jobless benefits rose 2,000 last week to 205,000. Continuing claims declined 1,000 to 1.865 million. These figures are consistent with moderate job growth in December. Finally, in manufacturing news this morning, the Philadelphia Fed Index, a measure of factory sentiment in that region, declined to -10.5 in December from -5.9 in November, signaling sluggishness in the factory sector.