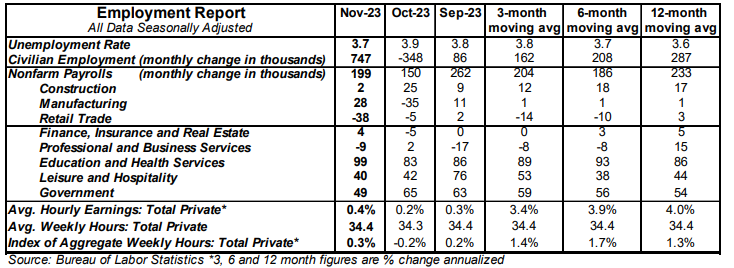

- Nonfarm payrolls increased 199,000 in November, narrowly beating the consensus expected 185,000. Payroll gains for September and October were revised down by a total of 35,000, bringing the net gain, including revisions, to 164,000.

- Private sector payrolls rose 150,000 in November but were revised down by 61,000 in prior months. The largest increases in November were health care (+77,000), restaurants & bars (+38,000), and manufacturing (+28,000). Government rose 49,000.

- The unemployment rate fell to 3.7% in November from 3.9% in October.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.4% in November and are up 4.0% versus a year ago. Aggregate hours rose 0.3% in November and are up 1.3% from a year ago.

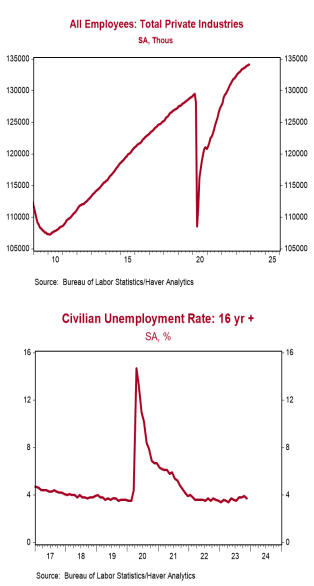

Implications: The job market continued to move forward in November, but there’s some trouble lurking under the hood. First the good news. Nonfarm payrolls rose 199,000 in November, narrowly beating consensus expectations. Civilian employment, an alternative (but volatile) measure of jobs that includes small-business start-ups surged 747,000, helping push the unemployment rate down to 3.7%. Meanwhile, the labor force (people who are working or looking for work) rose 532,000 and the share of the population (age 16+) with jobs rose to 60.5%, the highest since the onset of COVID. But here’s why there’s trouble lurking under the hood. Private payrolls rose 150,000 in November itself while revisions to prior months reduced private payrolls by 61,000, bringing the net gain to a modest 89,000. But that modest net gain included about 38,000 fewer workers on strike. Without that strike effect, net private payroll gains would have been about 51,000 for the month. In other words, although the headlines from the labor market remain strong, they are also consistent with an economy ultimately headed for recession. In terms of the Federal Reserve and short-term interest rates, average hourly earnings rose a healthy 0.4% in November. However, that was likely affected by the return to work of relatively higher-wage auto workers. Average hourly earnings are up 4.0% from a year ago versus a gain of 5.0% in the year ending in November 2022. In other words, the Fed is probably satisfied with the gradual deceleration in wage growth and wage growth won’t be a major hurdle for the Fed to cut short-term rates when a recession arrives. In other recent news on the labor market, new claims for jobless benefits ticked up 1,000 to 220,000 last week while continuing claims dropped 64,000 to 1.861 million. The M2 measure of the money supply is down versus a year ago, the yield curve is inverted and likely to remain so, and short-term interest rates are attractive. This is a recipe for risk aversion among businesses in the year ahead and a reduction in business investment will likely lead the rest of the economy into recession. The labor market is often a lagging indicator and we expect the economy (real output) to noticeably weaken before employers stop hiring, on net. Expect continued job growth for the next few months, but a weakening and recessionary labor market is heading our way.