View from the Observation Deck

We update this post every few months so that investors can see which of the two styles (growth or value) are delivering the better

results. Click here to see our last post on this topic.

• Value stocks have tended to outperform growth stocks when the yield on the benchmark U.S. 10-year Treasury note

(T-note) rises, and growth stocks tend to outperform value when the yield on the 10-year T-note falls. The yield on the

10-year T-note rose by 359 basis points (bps) over the 3-year period ended 11/24/23, according to data from Bloomberg.

For comparison, the yield on the 10-year T-note rose 60 bps YTD through 11/24/23, with 51 bps of that increase occurring

since the end of July.

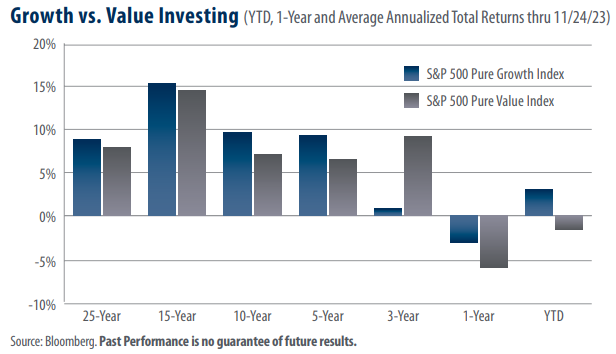

• The total returns in today’s chart are as follows (Pure Growth vs. Pure Value):

25-year avg. annual (8.82 % vs 7.92%)

15-year avg. annual (15.30% vs. 14.55%)

10-year avg. annual (9.59% vs. 7.06%)

5-year avg. annual (9.31% vs. 6.47%)

3-year avg. annual (0.79% vs. 9.21%)

1-year (-3.06% vs. -6.00%)

YTD (3.06% vs. -1.59%)

• As of 10/31/23, the sector with the largest weighting in the Pure Growth Index was Energy at 29.6%, according to S&P

Dow Jones Indices. At 23.3%, Financials had the largest weighting in the S&P 500 Pure Value Index (Pure Value Index) on

the same date.

• With a YTD return of -0.81% through 11/24/23, Energy was the eighth-best performing sector out of 11 major sectors in the

S&P 500 Index. By comparison, Financials posted a YTD total return of 4.90%.

• The top three performing sectors and their YTD total returns (through 11/24/23) are as follows: Communication Services

(52.09%); Information Technology (51.75%); and Consumer Discretionary (33.72%). As of 10/31/23 those three sectors

comprised a combined 20.5% and 32.9% of the total weighting of the Pure Growth and Pure Value Indices, respectively.

Takeaway

As the total returns in today’s chart illustrate, the Pure Growth Index has enjoyed higher total returns than

the Pure Value Index in six of the seven time periods presented, including the YTD time frame. In our view,

expectations regarding near-term changes in the yield of the 10-year T-note may be influencing investors’

appetite for growth-oriented names. Debate regarding the direction of the federal funds target rate continues,

with the federal funds rate futures market pricing in just a 4.8% chance of a rate hike at the next Federal Open

Market Committee meeting on 12/13/23. The same futures market indicates a 62.2% chance of an interest

rate cut in June 2024. The reality is that regardless of the Federal Reserve’s next move, there’s no way to predict

the direction of the yield on the 10-year T-note. From our perspective, given the various averages presented in

today’s chart, investors may be best served by diversifying their capital allocations across both market styles.