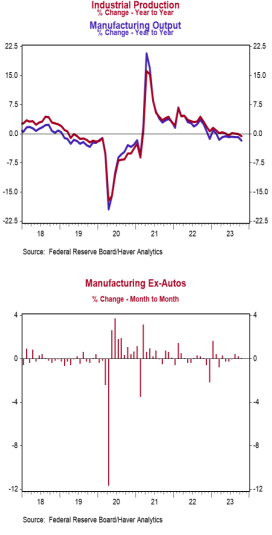

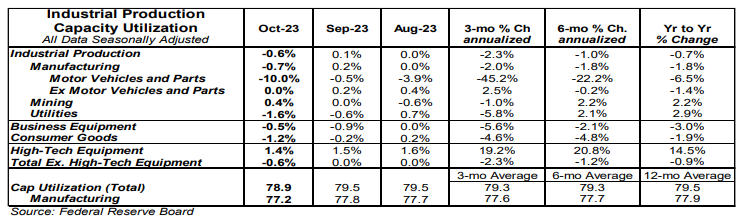

- Industrial production declined 0.6% in October (-0.9% including revisions to prior months) below the consensus expectation of -0.4%. Utilities output declined 1.6% in October, while mining increased 0.4%.

- Manufacturing, which excludes mining/utilities, dropped 0.7% in October. Auto production fell 10.0%, while non-auto manufacturing remained unchanged. Auto production is down 6.5% in the past year, while non-auto manufacturing is down 1.4%.

- The production of high-tech equipment rose 1.4% in October and is up 14.5% versus a year ago.

- Overall capacity utilization declined to 78.9% in October from 79.5% in September. Manufacturing capacity utilization dropped to 77.2% in October from 77.8%.

Implications: Industrial production disappointed in October with a 0.6% drop, tying the largest decline of 2023. Prior months’ data were revised down as well. While there wasn’t much to get excited about this morning, it is notable that most of October’s drop was due to the volatile auto manufacturing sector where activity plunged 10.0%. This is the biggest monthly decline since the early days of COVID when factories across the country shut down. However, the dive in October was driven by strike activity at many major manufacturers and should bounce back in November as strikers go back to work. Excluding the auto sector, manufacturing activity was unchanged. Another source of weakness in October was the utilities sector (which is volatile and largely dependent on weather), which posted a decline of 1.6%. The bright spot in today’s report was the mining sector, which increased 0.4% in October. A faster pace of oil and gas extraction along with drilling of new wells offset a decline in the extraction of other minerals. One other thing to highlight in today’s report was the production of high-tech equipment, which is up 14.5% in the past year, by far the strongest growth of any major category. Further, that growth has been accelerating recently, up at an even faster 20.8% annualized in the past six months. This likely reflects investment in AI as well as the reshoring of semiconductor production which remains strong due to the CHIPS Act despite broader weakness in the industrial sector. In other factory news this morning, the Philadelphia Fed Index, which measures manufacturing sentiment in that region, rose to a still weak reading of -5.9 in November from -9.0 in September. The region is home to auto manufacturers who were likely affected by the UAW strike. In employment news this morning, initial claims for jobless benefits rose 13,000 last week to 231,000. Meanwhile, continuing claims rose 32,000 to 1.865 million. Also today, import prices fell 0.8% in October while export prices declined 1.1%. In the past year, import prices are down 2.0% while export prices are down 4.9%. Finally, the NAHB Housing Index, a measure of homebuilder sentiment, fell to 34 in November from 40 in October. This is the fourth consecutive decline and coincides with a recent jump in mortgage rates. A reading below 50 signals that a greater number of builders view conditions as poor versus good.