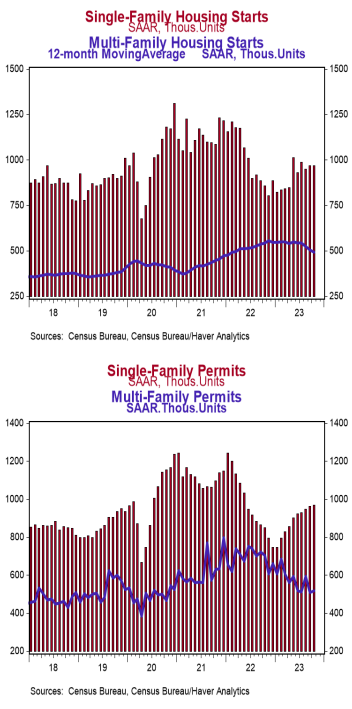

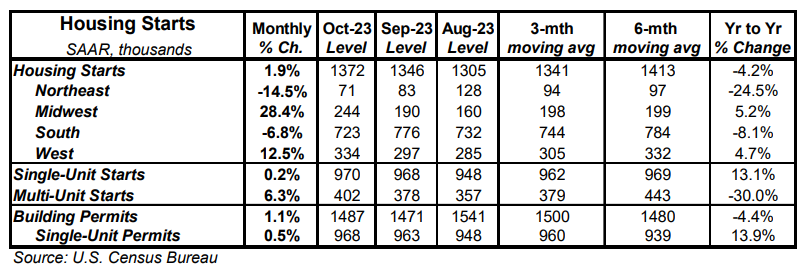

- Housing starts increased 1.9% in October to a 1.372 million annual rate, beating the consensus expected 1.350 million. Starts are down 4.2% versus a year ago.

- The gain in October was due to both single-family and multi-unit starts. In the past year, single-family starts are up 13.1% while multi-unit starts are down 30.0%.

- Starts in October rose in the Midwest and West, but fell in the South and Northeast.

- New building permits rose 1.1% in October to a 1.487 million annual rate, beating the consensus expected 1.450 million. Compared to a year ago, permits for single-family homes are up 13.9% while permits for multi-unit homes are down 26.4%.

Implications: Housing starts rose slightly in October, as homebuilders continue to wrestle with all kinds of headwinds, crosswinds, and tailwinds. Looking at the big picture, during COVID, a combination of extremely low interest rates and pressure to work from home led to a big migration to the suburbs (and beyond) and high demand for single-family homes. Then the economy reopened, causing many people to flock back to cities, sparking a boom in apartment projects. Currently, the number of multi-unit properties under construction is hovering near record levels, going back to 1970, when records began. Now it looks like the move back to the cities has petered out leaving a glut of apartments. Meanwhile, owners of existing homes are hesitant to list their properties and give up fixed sub-3% mortgage rates, so many prospective buyers have turned to new builds as their best option. This has created a huge gap in the data, with construction of single-family homes up 13.1% in the past year while multi-unit starts are down 30.0%. In other words, home building isn’t falling off a cliff and this isn’t a repeat of the prior housing bust. Looking at the details of today’s report, both single-family and multi-unit starts contributed to the headline gain in October, although starts were revised down modestly in prior months. Housing permits rose 1.1% in October, beating the consensus expectation, driven both by single-family and multi-units. Notably, single-family permits have risen every month since early this year, signaling that developers are finally finding their footing in what has been a challenging year of sales. While we don’t see housing as a driver of economic growth in the near term, recent numbers are certainly not what you’d expect to see if there was a severe housing bust like the 2000s on the way, either.