View from the Observation Deck

The Energy Information Administration (EIA) reported that U.S. petroleum consumption averaged nearly 20.28 million barrels per day in 2022, an increase of almost 12% from average daily consumption in 2020, according to its own release. While many pundits estimate that petroleum usage will decline over the long-term, oil was the most-consumed energy source in the U.S. on an annual basis last year. The price of crude oil tends to fluctuate wildly based off a myriad of economic and market factors, but the EIA notes that changes in supply and demand caused by economic growth and contraction are often leading causes behind oil price swings. Today’s post contrasts the price of West Texas Intermediate (WTI) crude oil to the number of rotary drilling rigs (a proxy for supply) deployed in the U.S. on a weekly basis, over a two-year time frame.

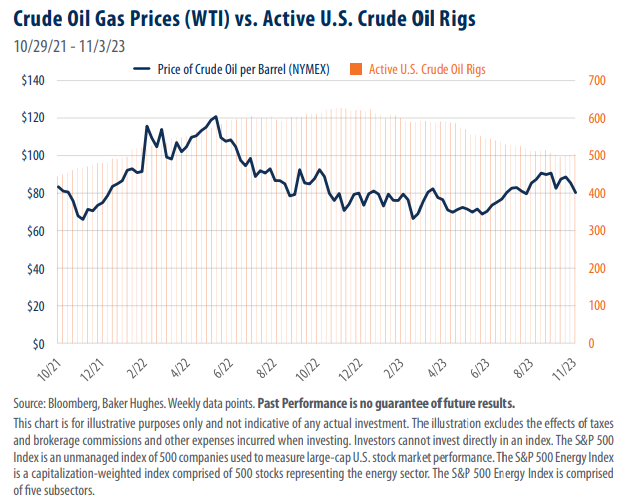

• The average price (daily data) of crude oil for the period captured in the chart above was $85.92 per barrel. The highest closing price for the period was $123.70 per barrel on 3/8/22.

• While it remains well off its most-recent high, the price of WTI crude oil stood at $80.51 per barrel at the close of trading on 11/3/23, down 3.66% from its closing price of $83.57 on 10/29/21, according to data from Bloomberg.

• For comparative purposes, the S&P 500 Energy Index posted an average annual total return of 27.83% over the period in today’s chart, according to data from Bloomberg. The average annual total return for the S&P 500 Index was -1.14% over the same time frame. The top-performing energy subsector, of which there are five, was the S&P 500 Oil & Gas Refining & Marketing subsector, with an average annual total return of 39.62%.

• The number of active oil rigs rose from 444 on 10/29/21 to 496 rigs on 11/3/23, according to data from Baker Hughes. The most recent high for the metric was 627 on 11/25/22.

Takeaway

On 11/7/23, the price of a barrel of WTI crude oil stood at $77.37 per barrel, 37.45% below its most recent high of $123.70 (3/8/22). From our perspective, one reason the price of crude oil has yet to retest its most recent high could be the rise in the relative value of the U.S. dollar. From 10/29/21 through 11/3/23 (the period in the chart), the U.S. dollar rose by 11.58% against a basket of major foreign currencies, as measured by the U.S. Dollar Index (DXY). Another could be weakening prospects for economic growth. In its most recent World Economic Outlook published in October 2023, the International Monetary Fund (IMF) estimated U.S. and global real gross domestic product would grow by just 1.5% and 2.9%, respectively, in 2024, down from 5.9% and 6.3%, respectively, in 2021. In our view, if those forecasts prove to be wrong, it is possible that the price of oil could recover more quickly