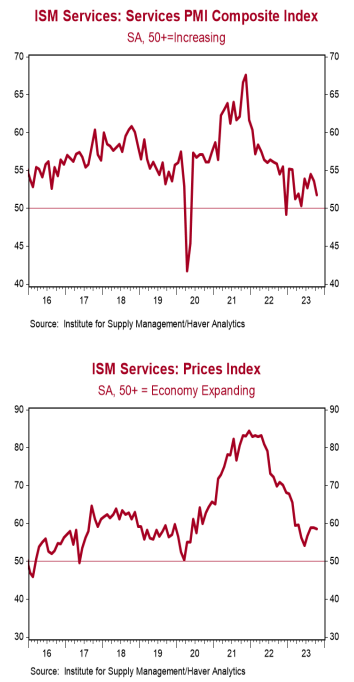

- The ISM Non-Manufacturing index declined to 51.8 in October, lagging the consensus expected 53.0 (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mostly lower in October. The business activity index dropped to 54.1 from 58.8, while the new orders index rose to 55.5 from 51.8. The employment index declined to 50.2 from 53.4, while the supplier deliveries index fell to 47.5 from 50.4.

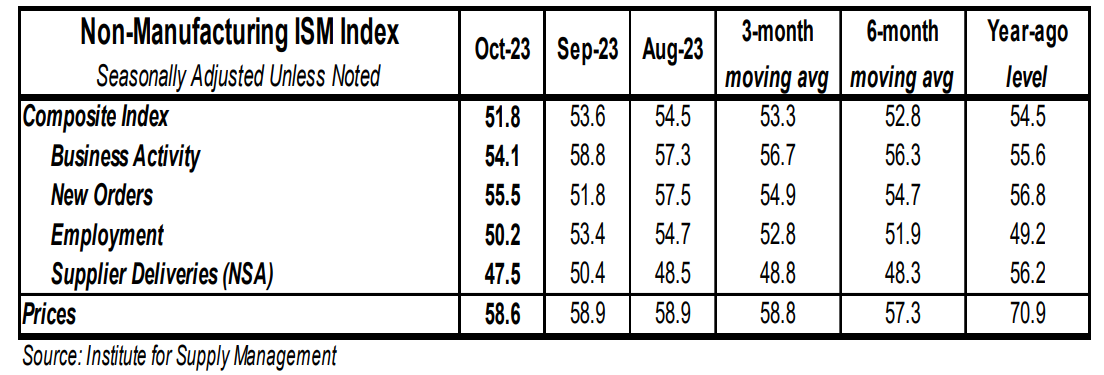

- The prices paid index ticked down to 58.6 from 58.9 in September.

Implications:

The service sector continued to expand in October, but the pace of growth is slowing. The headline index declined to 51.8 in October, missing the consensus expected 53.0, with twelve out of eighteen major industries reporting growth. When you contrast this with the October ISM report on the manufacturing sector – where activity has contracted every month of the last year and only two industries reported growth in October – there has clearly been a divergence in activity, where output has been shifting back toward services following the COVID-era when goods-related activity was artificially boosted. Looking at the details of today’s report, the two most forward-looking categories – new orders and business activity – were a mixed bag in October, as the new orders index bounced back to 55.5 after a notable drop the month prior, while the business activity index slipped to 54.1 from 58.8. Still, both sit in healthy expansion territory and have remained above 50 each month of the year so far. Survey comments reflected a murkier outlook than before, citing labor pressures, a potential government shutdown, and conflict in the Middle East as threats to future activity. Labor pressures can be seen in the employment index, which dropped to 50.2 in October but has now expanded the last five months. Comments on employment continue to signal that a lack of supply, not demand, has been the problem for hiring in the service sector. Finally, the highest reading out of any of the categories continues to come from the prices index, which ticked down to a still elevated 58.6 in October. Survey comments confirm that inflation remains a problem for businesses in the service sector. Although the Federal Reserve has gained some traction in the fight against inflation, we expect the service sector to keep inflation trending above the 2.0% target for some time. As for the economy, even though services are still expanding, we continue to believe a recession is on the way. Expect the service sector to weaken in the year ahead, as the impact of the recent reductions in the M2 measure of the money supply make their way through the economy.