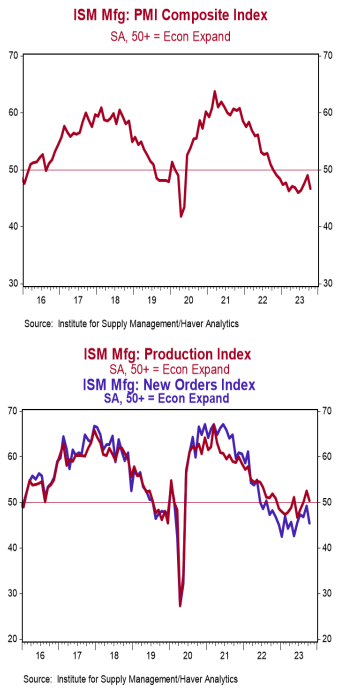

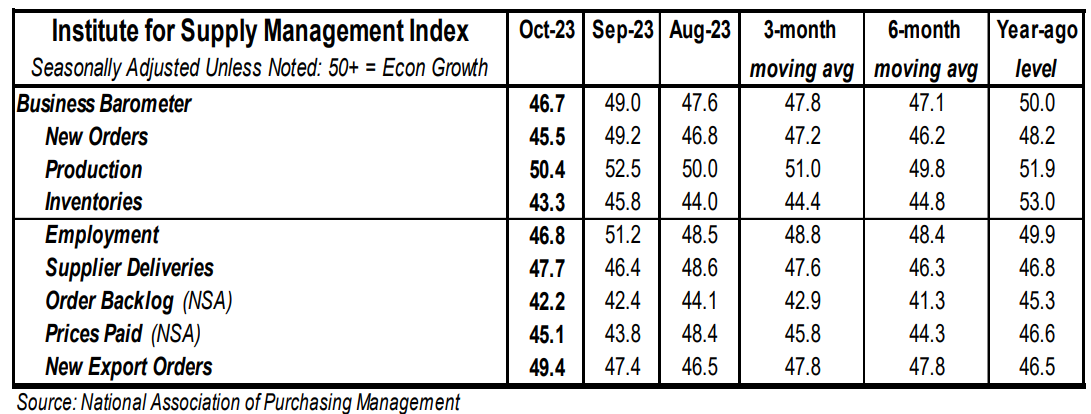

- The ISM Manufacturing Index declined to 46.7 in October, lagging the consensus expected 49.0. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mostly lower in October. The new orders index declined to 45.5 from 49.2 in September, while the production index fell to 50.4 from 52.5. The employment index dropped to 46.8 from 51.2 in September and the supplier deliveries index increased to 47.7 from 46.4.

- The prices paid index rose to 45.1 in October from 43.8 in September.

Implications:

Activity in the US factory sector contracted in October and has done so every month in the last year. We continue to believe a recession is lurking ahead and the details of today’s report suggest the goods sector of the economy is likely to lead the way. On the surface level, just two out of eighteen major industries reported growth in October. Survey comments cited weakening demand, slowing activity, and dwindling optimism for 2024. Weakening demand was most easily seen in the new orders index, which remained in contraction for a fourteenth consecutive month. Meanwhile, the production index remained in expansion territory – albeit slightly – for the second month in a row. With the combination of less demand from consumers and built-up inventories at retailers, we don’t expect a significant rebound in manufacturing output. However, fewer orders and faster production have allowed factories to catch up on order backlogs. That measure fell to 42.2 in October and remains near the lowest readings since the 2008 Financial Crisis. Meanwhile, the employment index continues to come in choppy, dropping to 46.8 from 51.2 the previous month. Finally, on the inflation front, the prices index rose to 45.1 in October but has been sitting in contraction territory for the last six months, showing that tighter money since 2022 is gaining some traction against inflation. In other news this morning, construction spending increased 0.4% in October. The gain was driven by large increases in home building and educational facilities, which more than offset declines in manufacturing projects. On the labor front, ADP’s measure of private payrolls increased 113,000 in October versus a consensus expected 150,000. We expect Friday’s payroll report to show a nonfarm payroll gain of 177,000. Finally, in recent housing news, the national Case-Shiller index rose 0.9% in August while the FHFA index rose 0.6% and both show home prices at a new all-time high. Notably, these indices sit 4.4% and 7.5%, respectively, above March 2022 (when the Federal Reserve began their current tightening cycle) after a brief drop in the second half of last year, indicating this is not a repeat of 2008.