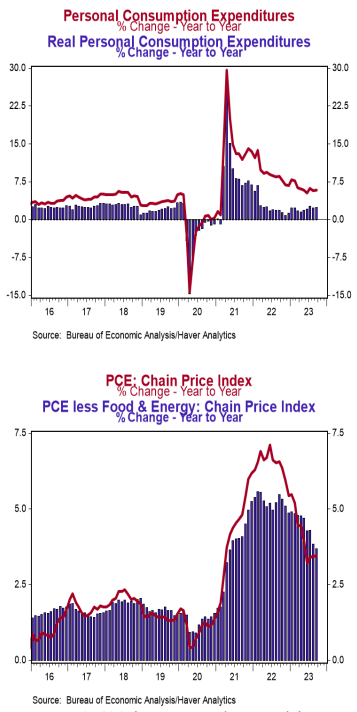

- Personal income rose 0.3% in September (+0.4% including revisions to prior months), versus a consensus expected +0.4%. Personal consumption rose 0.7% in September, beating the consensus expected +0.5%. Personal income is up 4.7% in the past year, while spending has increased 5.9%.

- Disposable personal income (income after taxes) rose 0.3% in September and is up 7.1% from a year ago.

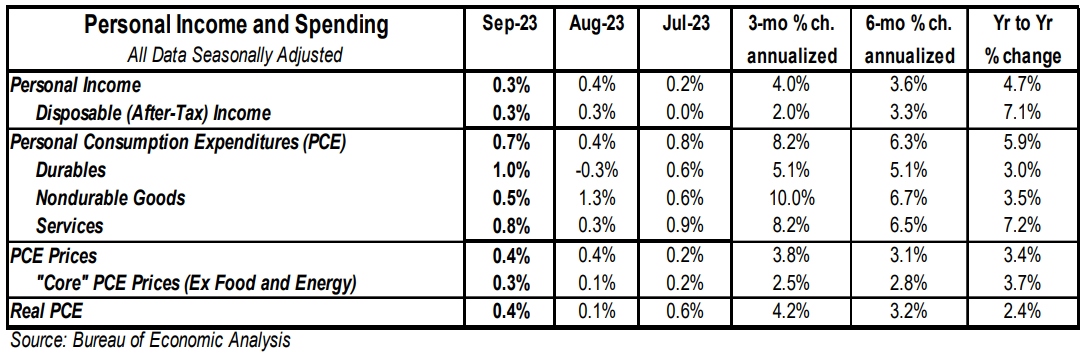

- The overall PCE deflator (consumer prices) rose 0.4% in September and is up 3.4% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.3% in September and is up 3.7% in the past year.

- After adjusting for inflation, “real” consumption rose 0.4% in September and is up 2.4% from a year ago.

Implications:

Incomes continued to rise, and consumers continued to spend in September, putting pressure on the Fed as it continues to battle inflation. The best news in today’s report was that incomes rose 0.3% in September and are up 4.7% in the last year, led by gains in private-sector wages & salaries (+0.3% for the month and up 5.0% year-to-year). The pickup in consumer spending outpaced the growth in income in September, rising 0.7%, with healthy spending across both goods and services. Goods spending rose 0.7% on the month and is up 3.3% in the past year, while “real” inflation-adjusted spending on goods is up 2.4%. Spending on services rose 0.8% in September and is up 7.2% in the past year (2.4% when adjusted for inflation). On the inflation front, PCE prices – the Federal Reserve’s preferred measure of inflation – rose 0.4% in September, bringing the twelve-month comparison up to 3.4%. Look for a more tepid rise in inflation in October given the decline in oil prices over the past month. “Core” inflation, which excludes the ever-volatile food and energy categories, is up 3.7% versus a year ago. Note that the Fed has prioritized a subset of inflation dubbed the “Super Core,” which is services only (no goods), excluding food, energy, and housing. That measure rose 0.4% in September and is up 4.3% versus a year ago (down less than a percentage point from the 5.2% peak in October 2022). Inflation continues to take a toll on the economy, which is also likely to soon feel more of the effects of the decline in the money supply over the past year. On the housing front, pending home sales, which are contracts on existing homes, rose 1.1% in September following a 7.1% decline in August. Plugging these figures into our model suggests existing home sales will decline slightly in October. In recent manufacturing news, the Kansas City Fed index, a measure of factory activity in that area, remained at a reading of -8 in October. We expect next week’s national manufacturing report to come in at 48.7, still signaling contraction.