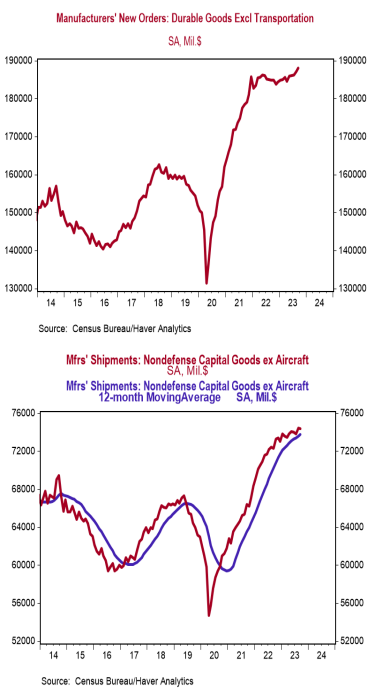

- New orders for durable goods surged 4.7% in September (+4.4% including revisions to prior months), easily beating the consensus expected +1.9%. Orders excluding transportation rose 0.5% (+0.6% including revisions), versus a consensus expected +0.2%. Orders are up 7.8% from a year ago, while orders excluding transportation have risen 1.7%.

- Rising orders for commercial aircraft, machinery, and fabricated metal products led gains across most major categories.

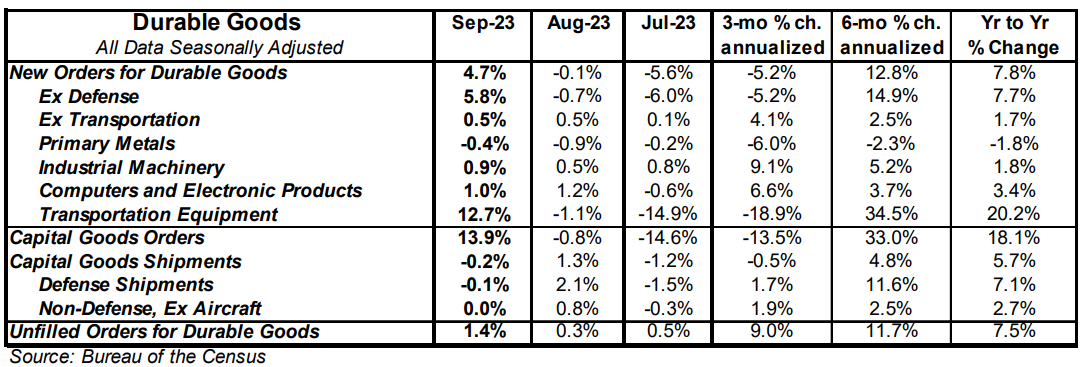

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure was unchanged in September but rose at a 1.3% annualized rate in Q3 versus the Q2 average.

- Unfilled orders rose 1.4% in September and are up 7.5% in the past year.

Implications:

Durable goods orders surprised to the upside in September, with growth across most major categories. A surge in commercial aircraft (+92.5% in September) was the major contributor to growth in new orders, following large declines in these aircraft orders the prior two months. Strip out the typically volatile transportation category and orders for durable goods still rose a healthy 0.5% in September, with gains across most major categories. Machinery led ex-transportation orders higher, rising 0.9% in September, while fabricated metal products (+0.9%), computers & electronic products (+1.0%), and electrical equipment (+0.9%) also rose. Primary metals products was the lone major category to decline outside the transportation sector, down 0.4%. Arguably the most important number in today’s report is core shipments – a key input for business investment in the calculation of GDP – which was unchanged in September. These shipments rose at a 1.3% annualized rate in Q3 vs the Q2 average (for more information on today’s Q3 GDP report, click here). The growth of shipments has been slowing since the start of 2022, and we expect this trend will continue as the economy feels the lagged effects of the Federal Reserve’s actions to remove money from the system. In the past year, orders for durable goods are up 7.8%, while orders excluding transportation are up a more modest 1.7%. A number of factors are likely to keep the path forward rocky as we close out 2023: a tighter Federal Reserve, the tightening of lending standards following stress in the banking sector, and withdrawal symptoms following the COVID-era economic morphine that artificially boosted both consumer and business spending. In addition, the return toward services likely means goods-related activity will continue to soften in the year ahead, even as some durables that facilitate services recover. While the data to-date have shown continued economic growth, we believe a recession is likely before the end of 2024. In other news this morning, initial claims for jobless benefits rose 10,000 last week to 210,000. Meanwhile, continuing claims rose 63,000 to 1.790 million. These figures suggest continued growth in employment in October.