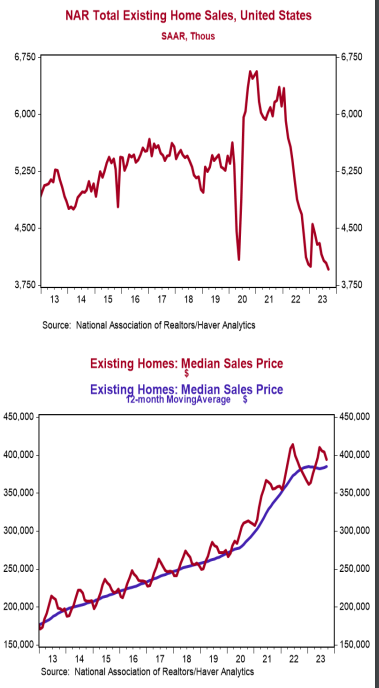

- Existing home sales declined 2.0% in September to a 3.960 million annual rate, beating the consensus expected 3.890 million. Sales are down 15.4% versus a year ago.

- Sales in September fell in the West, Midwest and South, but rose in the Northeast. The drop in September was due to both single-family homes and condos/co-ops.

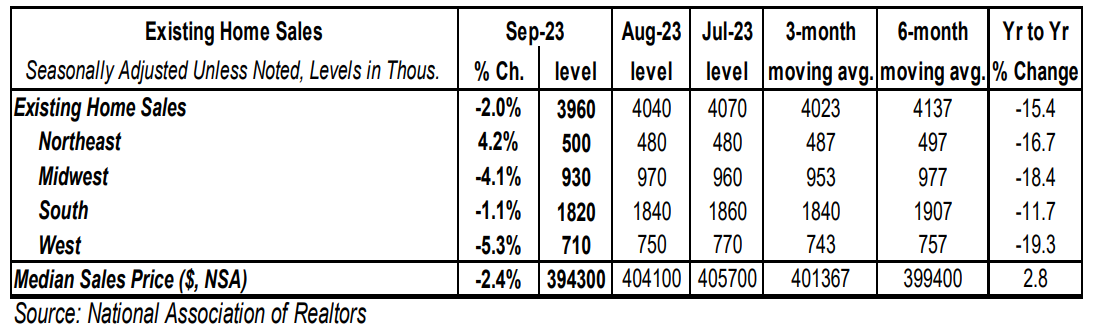

- The median price of an existing home fell to $394,300 in September (not seasonally adjusted) and is up 2.8% versus a year ago.

Implications:

Existing home sales fell for a fourth consecutive month in September, hitting the slowest pace since the aftermath of the 2008/9 Financial Crisis. The housing market is facing a series of headwinds, some of them temporary. The first (and most significant) has been the recent surge in benchmark interest rates like the 10-year Treasury yield. This has translated into 30-year fixed mortgage rates as well, which are currently hovering near 8% for the first time in more than two decades. Assuming a 20% down payment, the rise in mortgage rates since the Federal Reserve began its current tightening cycle in March 2022 amounts to a 40% increase in monthly payments on a new 30-year mortgage for the median existing home. Eventually, the housing market can adapt to these increases, but each surge in rates, like we’ve experienced lately, leads to some indigestion. In addition, many existing homeowners are reluctant to sell due to a “mortgage lock-in” phenomenon, after buying or refinancing at much lower rates before 2022. That should limit future existing sales (and inventories). Case in point, the months’ supply of homes (how long it would take to sell existing inventory at the current very slow sales pace) was 3.4 in September, well below the benchmark of 5.0 that the National Association of Realtors uses to denote a normal market. A tight inventory of existing homes means that while the pace of sales may resemble 2008, we aren’t seeing that translate to a big decline in prices. In fact, home prices appear to be rising again, although modestly, with the median price of an existing home up 2.8% from a year ago. Finally, a weakening economy in which the Federal Reserve doesn’t act quickly to cut rates, because of high inflation, could be a headwind for home sales next year. Adding this altogether, expect sales and prices to drag on in the year ahead, with no persistent recovery in existing home sales until at least late 2023 or early 2024. In employment news this morning, initial claims for jobless benefits fell 13,000 last week to 198,000. Meanwhile, continuing claims rose 29,000 to 1.734 million. These figures suggest continued growth in employment in October. Finally on the factory front, the Philadelphia Fed Index, which measures manufacturing sentiment in that region, rose to a still weak reading of -9.0 in October from -13.5 in September. The region is home to auto-parts manufacturers who are likely affected by the UAW strike.