View from the Observation Deck

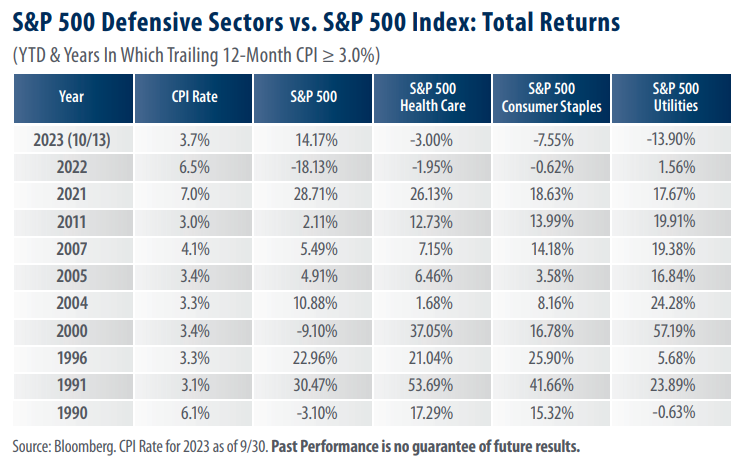

For today’s post, we looked back to 1990 and selected calendar years where inflation, as measured by the Consumer Price Index (CPI), rose by 3.0% or more on a trailing 12-month basis. We chose 3.0% as our baseline because the rate of change in the CPI averaged 3.0% from 1926-2022, according to data from the Bureau of Labor Statistics. Once we had our time frames, we selected three defensive sectors (Health Care, Consumer Staples, and Utilities) and compared their total returns to those of the S&P 500 Index.

The S&P 500 Index outperformed each of the Health Care, Consumer Staples, and Utilities sectors in just two of the eleven time frames presented (year-to-date (YTD) thru 10/13/23 and in 2021).

As many investors likely know, because defensive sectors tend to be less cyclical, they may offer better performance than their counterparts during periods of heightened volatility. Today’s table reveals that defensive sectors may offer better performance relative to their peers during periods of higher inflation as well.

From 12/29/89 – 10/13/23 (period captured in the table above), the average annualized total returns posted by the four equity indices in the table were as follows (best to worst): 11.44% (S&P 500 Health Care); 10.15% (S&P 500 Consumer Staples); 9.93% (S&P 500); and 7.68% (S&P 500 Utilities); according to data from Bloomberg.

With a total return of -13.90 on a YTD basis through 10/13/23, utilities are the worst-performing of the defensive sectors shown. In our view, one reason for the sector’s precipitous decline could be the recent surge in the yield on the 10-year Treasury Note (T-note). As of 10/13/23, the yield on the 10-year T-note stood at 4.61%, an increase of 74 basis points on a YTD basis, making government bonds an attractive alternative to utility stocks from a cash flow perspective.

Takeaway

As today’s table reveals, the S&P 500 Index outperformed each of the Health Care, Consumer Staples, and Utilities sectors in just two of the eleven time frames presented (YTD thru 10/13/23 and in 2021). Given these results, the obvious question is this: why have defensive stocks underperformed this year even though inflation remains stubbornly high? As we see it, investors’ risk appetite may offer one explanation. Driven by the Artificial Intelligence trade, the S&P 500 Index posted a total return of 14.17% YTD through 10/13/23. The bond market echoes a similar sentiment. As many investors are likely aware, bond prices move inversely to their yields. YTD through 10/13/23, the yield on the 10-year T-note rose by 74 bps, indicating a sharp sell-off in fixed income. That said, investors will often use defensive sectors as a safe haven during times of increased volatility, as well as during periods of heightened inflation. We would expect to see heightened interest in defensive sectors should volatility rise or the U.S. economic outlook sour in the coming months.