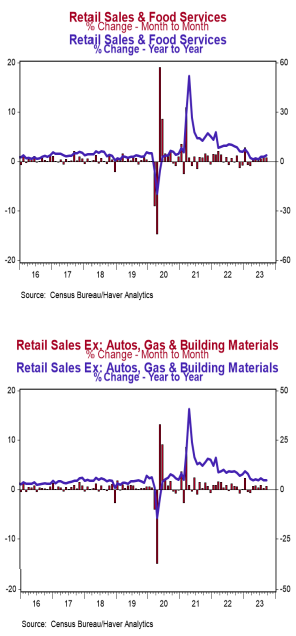

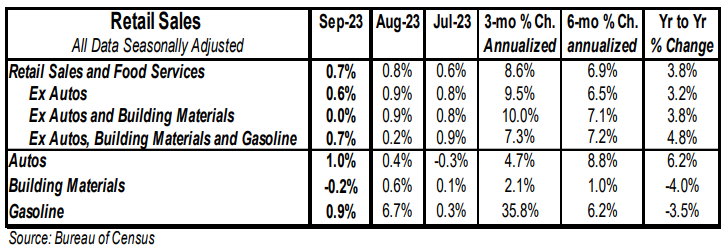

- Retail sales rose 0.7% in September (+1.0% including revisions to prior months), easily beating the consensus expected gain of 0.3%. Retail sales are up 3.8% versus a year ago.

- Sales excluding autos increased 0.6% in September (+1.0% including revisions to prior months). The consensus expected a 0.2% gain. These sales are up 3.2% in the past year.

- The largest increases in September, were for autos, non-store retailers (internet and mail-order), and restaurants & bars.

- Sales excluding autos, building materials, and gas rose 0.7% in September, and were up 0.9% including revisions to prior months. These sales were up at 7.1% annual rate in Q3 versus the Q2 average.

Implications:

A very strong report on the consumer today with retail sales increasing 0.7%, easily beating the consensus expected gain of 0.3%. Factoring in revisions to previous months, retail sales grew an even faster 1.0%. Sales rose in eight of the thirteen major categories for the month led by autos, which increased 1.0%, followed by sales at non-store retailers (internet & mail order), and restaurants & bars. “Core” sales, which exclude volatile categories such as autos, building materials, and gas stations – crucial for estimating GDP – increased by 0.7% in September and were revised upward for previous months. These sales were up at a 7.1% annual rate in Q3 compared to the Q2 average. This is consistent with our view that real GDP growth will be unusually strong in the third quarter, before decelerating rapidly late this year. Consumers are starting to run out of excess COVID savings, which were boosted by temporary and artificial government stimulus payment. Over the past twelve months, overall retail sales have risen by 3.8%, basically matching inflation, indicating only a slight increase in “real” retail sales. While retail sales boomed and hit another record high this month, real retail sales peaked back in April 2022 and have since declined by 2.1% from that peak. Our view remains that the tightening in monetary policy since last year will eventually deliver a recession. Expect more deterioration in real retail sales later this year.