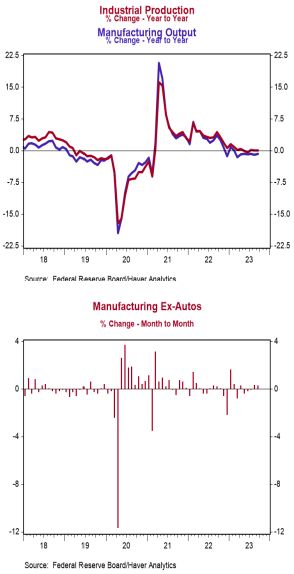

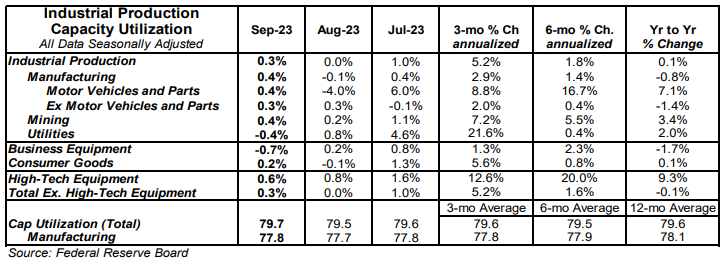

- Industrial production increased 0.3% in September (+0.1% including revisions to prior months) beating the consensus expectation of 0.0%. Utilities output declined 0.4% in September, while mining increased 0.4%.

- Manufacturing, which excludes mining/utilities, rose 0.4% in September (0.0% including revisions to prior months). Auto production rose 0.4%, while non-auto manufacturing increased 0.3%. Auto production is up 7.1% in the past year, while non-auto manufacturing is down 1.4%.

- The production of high-tech equipment rose 0.6% in September and is up 9.3% versus a year ago.

- Overall capacity utilization increased to 79.7% in September from 79.5% in August. Manufacturing capacity utilization increased to 77.8% in September from 77.7%.

Implications:

Industrial production surprised to the upside in September, driven by broad-based gains across nearly every major category. Notably, industrial activity has been accelerating recently, rising at a 5.2% annualized pace in the past three months versus just 1.8% annualized over the past six months and 0.1% in the past year. The largest sub-component, manufacturing activity, rose 0.4% in September. Looking at the details, both auto and non-auto manufacturing contributed, rising 0.4% and 0.3% respectively. Meanwhile, output in the mining sector increased 0.4% in September. A faster pace of oil and other mineral extraction more than offset a decline in the production of natural gas. With new geopolitical concerns in the Middle East and WTI crude prices that have recently surged back above $85 a barrel, we expect mining to continue to be a tailwind for industrial production in the near term. Meanwhile, the utilities sector (which is volatile and largely dependent on weather) was the one major source of weakness in September, posting a decline of 0.4%. While welcome news for now, we expect industrial production to soon weaken due the lagged effects of tighter money. In other recent factory news, the Empire State Index, a measure of New York factory sentiment, fell to -4.6 in October from 1.9 in September. Finally this morning, the NAHB Housing Index, a measure of homebuilder sentiment, fell to 40 in October from 44 in September. This is the third consecutive decline and coincides with a recent jump in mortgage rates. An index reading below 50 signals that a greater number of builders view conditions as poor versus good.