View from the Observation Deck

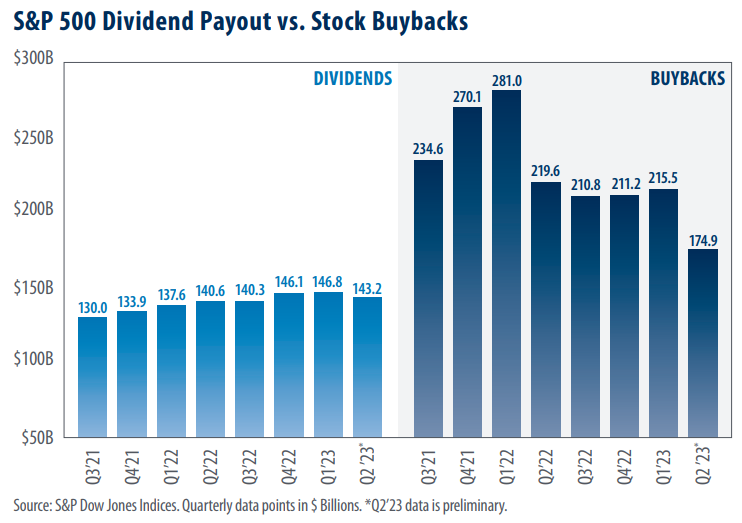

Companies have a number of ways in which to return capital to their shareholders. As the chart above shows, cash dividends and stock buybacks have been two of the more popular methods that corporations have utilized in recent years. Apart from Q3’22 and Q2’23, dividend distributions steadily increased over the period. For comparison, share buybacks remain well-below their peak set in Q1’22. Even so, buybacks were still a more significant source of overall capital disbursements than dividend distributions over the period in today’s chart.

• Total shareholders return of dividends and buybacks stood at $1.389 trillion during over the trailing 12-month period ended June 2023.

• In total, the companies that comprise the S&P 500 Index distributed a record $576.4 billion as dividends over the trailing 12-month period ended June 2023, up from $542.1 billion over the same period last year.

• Dividend distributions increased on a quarterly basis in five of the quarters represented in today’s chart.

• Despite the downward trend revealed in the most recent data, annual share repurchases stood at a record $922.7 billion for the 2022 calendar year.

• Buybacks totaled $812.5 billion over the 12-months ending June 2023, down from the record $1.005 trillion over the 12-month period ended June 2022.

• Quarterly stock buybacks totaled $174.9 billion in Q2’23, down from $215.5 billion in Q1’23.

• Year-to-date through Q2’23, the S&P 500 Index sectors that were most aggressive in repurchasing their stock were as follows (% of all stocks repurchased): Information Technology (27.0%); Financials (18.7%); and Communication Services (14.5%), according to S&P Dow Jones Indices

Takeaway

As indicated in today’s chart, both dividend distributions and stock buybacks declined in Q2’23. That said, total dividend distributions stood at a record $576.4 billion over the trailing 12-months ended June 2023. For comparison, stock buybacks stood at $812.5 billion over the same period, down from the record $1.005 trillion over the trailing 12-months ended in June 2022. Stock buybacks fell by 18.8% on a quarter-over-quarter basis in Q2’23, with Health Care and Real Estate stock repurchases falling by 42.2% and 86.5%, respectively, over the quarter. Dividend distributions remained relatively consistent over the time frame. In our view, this is to be expected. Generally, companies tend to avoid cutting their dividend, as the action can be seen as an indication of financial weakness..