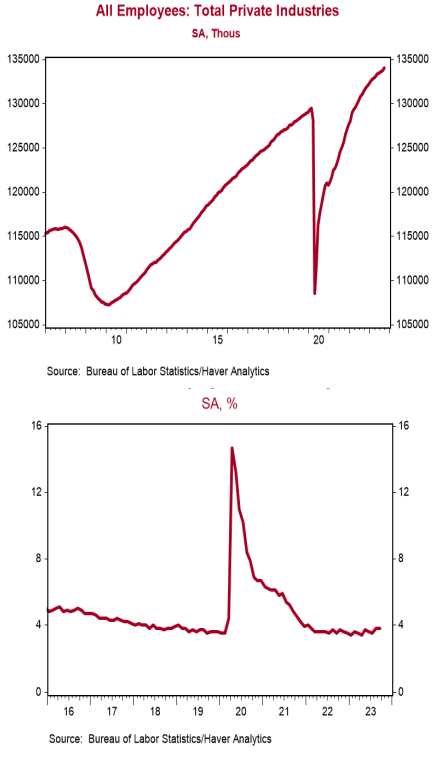

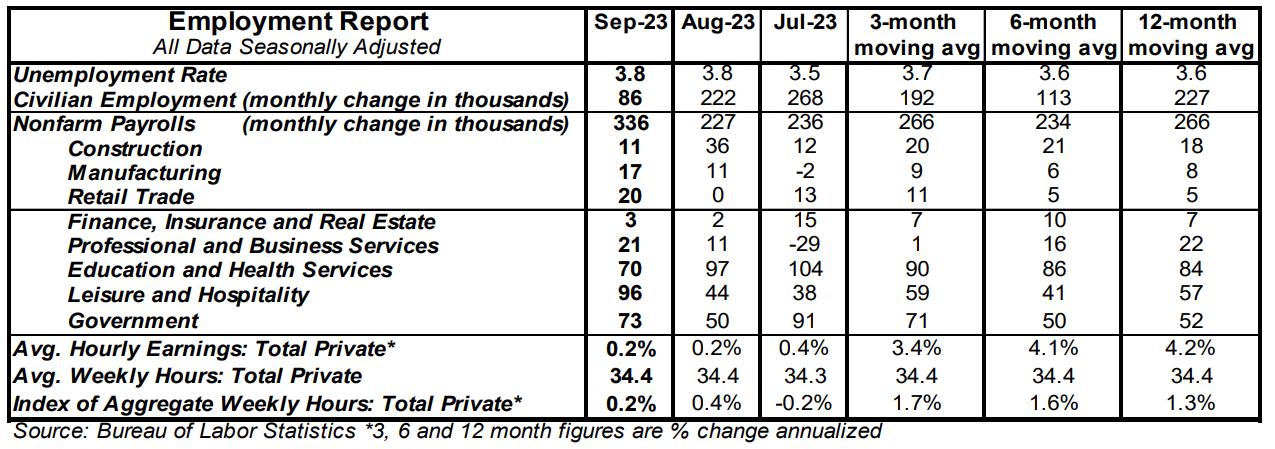

- Nonfarm payrolls increased 336,000 in September, easily beating the consensus expected 170,000. Payroll gains for July and August were revised up by a total of 119,000, bringing the net gain, including revisions, to 455,000.

- Private sector payrolls rose 263,000 in September but were revised down by 12,000 in prior months. The largest increases in September were for leisure & hospitality (+96,000) and health care & social assistance (+66,000). Manufacturing increased 17,000 while government rose 73,000.

- The unemployment rate was unchanged at 3.8%.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.2% in September and are up 4.2% versus a year ago. Aggregate hours rose 0.2% in September and are up 1.3% from a year ago.

Implications:

This was not what the Federal Reserve or many investors wanted to see. The labor market was strong in September, raising the odds of one more rate hike and making it more likely the Fed holds short-term rates at least at current levels for longer into 2024. Nonfarm payrolls rose 336,000 in September, easily beating the consensus expected 170,000. Gains in jobs were widespread, and led by increases in leisure & hospitality as well as health care & social assistance. We like to follow the total number of hours worked in the private sector, which rose 0.2% for the month and is up 1.3% versus a year ago. However, not all the news on the labor market was quite as strong. Although some might be startled to see a large 119,000 upward revision in payrolls for prior months, all of that was from the government, with private payrolls revised down by 12,000. Civilian employment, an alternative measure of jobs that includes small-business start-ups, rose a lukewarm 86,000. Meanwhile, the unemployment rate remained steady at 3.8% as the labor force increased a moderate 90,000. The best news in today’s report was that average hourly earnings increased a modest 0.2%, although they’re still up 4.2% in the past year. Some might interpret these data as a reason to take the risk of a recession off the table, but we don’t agree. The labor market is often a lagging indicator and we expect the economy (real output) to noticeably weaken before employers stop hiring, on net. The M2 measure of the money supply is down versus a year ago, the yield curve is inverted and likely to remain so, and long-term yields have moved up substantially. This is a recipe for risk aversion among businesses in the year ahead and a reduction in business investment will likely lead the rest of the economy into recession. We expect continued job growth for the next few months, but foresee a weakening and recessionary labor market starting by early 2024.