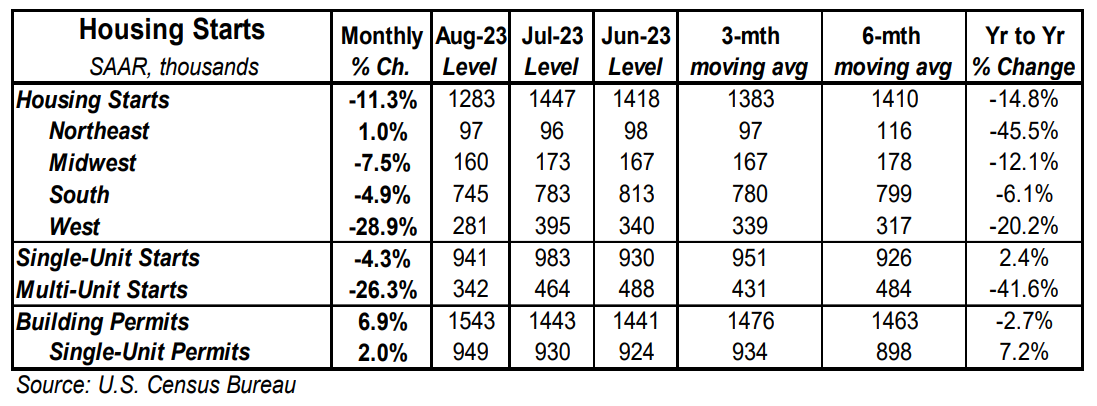

- Housing starts declined 11.3% in August to a 1.283 million annual rate, well below the consensus expected 1.439 million. Starts are down 14.8% versus a year ago.

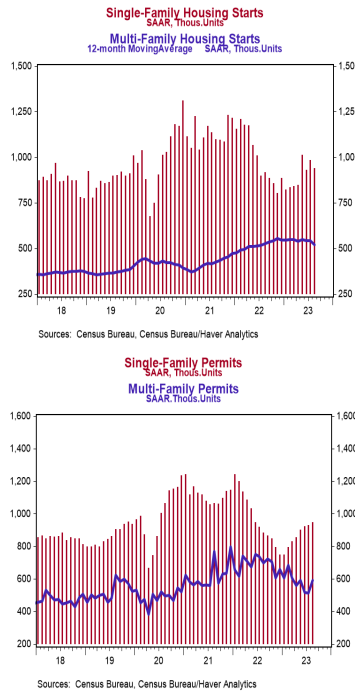

- The drop in August was due to both single-family and multi-unit starts. In the past year, single-family starts are up 2.4% while multi-unit starts are down 41.6%.

- Starts in August fell in the West, Midwest, and South, but rose in the Northeast.

- New building permits increased 6.9% in August to a 1.543 million annual rate, easily beating the consensus expected 1.440 million. Compared to a year ago, permits for single-family homes are up 7.2% while permits for multi-unit homes are down 15.3%.

Implications:

Housing starts posted the largest monthly decline in over a year in August, falling to the slowest pace since the worst of the COVID pandemic in 2020. However, we don’t see this as a sign of persistent weakness ahead in home building. While both single-family and multi-unit projects contributed to the decline, a massive 26.3% drop in the multi-unit category was largely responsible for today’s bad headline number. Looking at the big picture, during COVID, a combination of extremely low interest rates and pressure to work from home led initially to big migration to the suburbs and high demand for single-family homes. Then the economy reopened, causing many people to flock back to cities, sparking a boom in apartment projects. Currently, the number of multi-unit properties under construction is hovering near record levels going back to 1970 when records began. Now it looks like the move back to the cities has petered out leaving a glut of apartments. In contrast, owners of existing homes are hesitant to list their properties and give up fixed sub-3% mortgage rates, so many prospective buyers have turned to new builds as their best option. This has created a huge gap in the data, with construction of single-family homes up a modest 2.4% in the past year while multi-unit activity is down 41.6% over the same period. In other words, home building isn’t falling off a cliff like in the prior housing bust. Home completions rose 5.3% in August and permits for both single-family and multi-unit properties posted gains. In other recent housing news, the NAHB Housing Index, a measure of homebuilder sentiment, fell to 45 in September from 50 in August. This is the second decline in eight months and coincides with a recent jump in mortgage rates. An index reading below 50 signals that a greater number of builders view conditions as poor versus good.