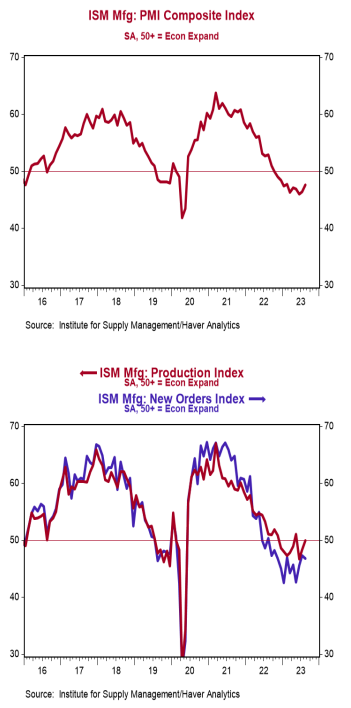

- The ISM Manufacturing Index increased to 47.6 in August, beating the consensus expected 47.0. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

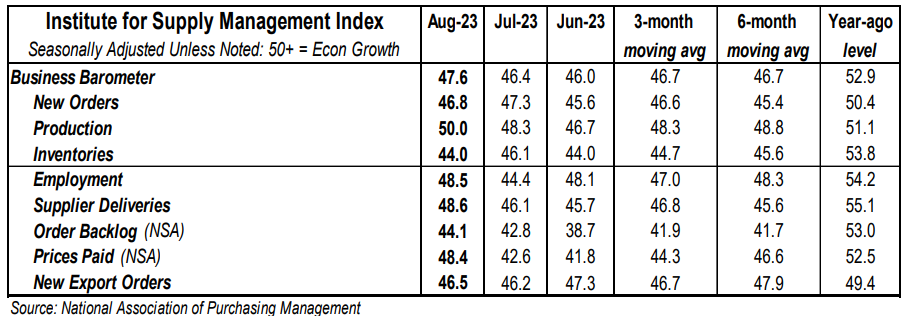

- The major measures of activity were mixed in August. The new orders index declined to 46.8 from 47.3 in July, while the production index rose to 50.0 from 48.3. The supplier deliveries index rose to 48.6 from 46.1 in July and the employment index increased to 48.5 from 44.4.

- The prices paid index increased to 48.4 in August from 42.6 in July.

Implications:

Activity in the US factory sector contracted for the tenth month in a row in August, though at a slightly slower pace. Looking at the details, only five of eighteen industries reported growth in August. Survey respondents noted slowing orders from customers across a wide range of industries and suggested that higher interest rates are beginning to impact demand as well. We continue to believe a recession is lurking ahead and today’s report shows the goods sector of the economy is likely to lead the way. Weakening demand was most easily seen in the new orders index, which fell to 46.8 in August. Given that spending has been shifting away from goods and back toward services it’s not surprising that this measure has remained in contraction for the past year. Meanwhile, the production index rebounded to 50.0 in August. With the combination of less demand from consumers and built-up inventories at retailers, we don’t expect this to turn into an upward trend. However, fewer orders and faster production have allowed factories to catch up on order backlogs. While that index did rise slightly in August, it remains near the lowest readings since the 2008 Financial Crisis. That said, the slowdown in orders and reduction in backlogs has begun to affect the employment index, which remained in contraction for the third month in a row at 48.5 in August. Finally, on the inflation front, the prices index rose to 48.4 in August. In other news this morning, construction spending increased 0.7% in July. The gain was driven by large increases in home building and manufacturing facilities, which more than offset declines in road construction and other transportation projects.