View from the Observation Deck

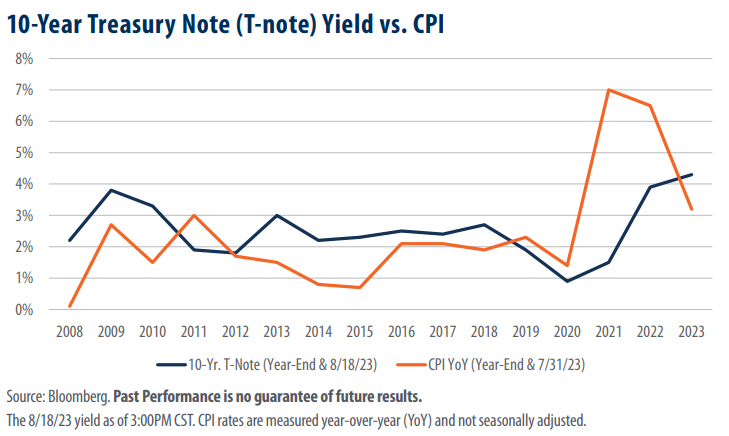

We update this chart from time to time to keep tabs on the effect of changing interest rates on the fixed income market. The real rate of return on a bond is calculated by subtracting the most recent rate of inflation, such as the 12-month trailing rate on the Consumer Price Index (CPI), from the bond’s current yield. Click Here to view our last post on this topic.

Good news! After 4 years of negative real yields, bonds are once again providing investors with a rate of return that outpaces the CPI.

The yield on the benchmark 10-year T-note was 4.26% on 8/18/23, above the 3.2% trailing 12-month rate on the CPI in July 2023, equating to a real yield of 1.1%. The benchmark’s current real yield represents a welcome reversal from where it stood just a few short months ago. In our last post published on 5/16/23, the real yield on the 10-year T-note stood at -1.4%. For comparative purposes, from 8/18/93 through 8/18/23 (30 years), the average yield on the 10-year T-note was 3.84%, while the average rate on the CPI stood at 2.5% (7/31/93-7/31/23), according to date from Bloomberg. Those figures translate into an average real yield of 1.34%, meaning the current real yield on the 10-year T-note stands nearly in line with its historical average.

As of 8/18/23, the federal funds target rate (upper bound) stood at 5.50%, up from 4.50% at the start of 2023, and significantly higher than when it stood at 0.25% at the start of 2022.

In an indication that tighter monetary policy is quelling rising prices, the CPI stood at 3.2% at the end of July 2023, significantly lower than its most recent peak of 9.1% set in June 2022. That said, the CPI remains above its 30-year average rate of 2.5% (addressed above), and even further from the goal rate of 2.0% that the Federal Reserve (“Fed”) is aiming to achieve. Notably, after 12-straight months of declining prices, the CPI rose from 3.0% in June 2023 to 3.2% in July. The passage of time will reveal if the Fed realizes their goal rate of 2% inflation without having to increase the federal funds target rate further.

Takeaway

It appears that the Fed’s tighter monetary policy has led to a moderation in the pace of rising prices. Inflation, as measured by the CPI, stood at 3.2% in July, down significantly from its most recent high of 9.1% set in June 2022. Fortunately for bond investors, higher interest rates have also ushered in better yields. As today’s chart reveals, after 4 years of negative real yields, bonds are once again providing investors with a rate of return that outpaces the CPI. While inflation is not the only metric the Fed looks to for guidance as it sets its target rate, it has openly stated that one of its goals is to reduce the CPI to 2.0% or lower. We’re not there yet. Whether or not the Fed can pull off the balancing act of moderating the pace of inflation without causing a recession is yet to be determined.