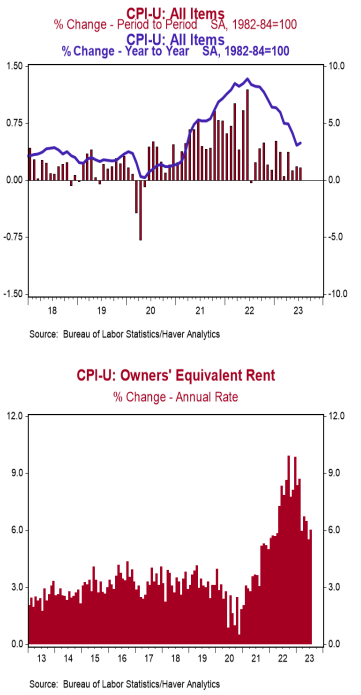

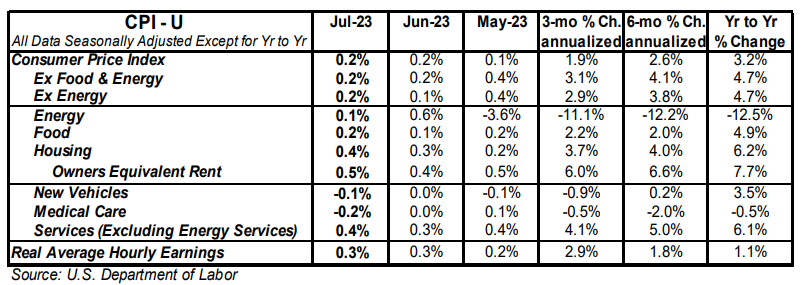

- The Consumer Price Index (CPI) rose 0.2% in July, matching consensus expectations. The CPI is up 3.2% from a year ago.

- Food prices rose 0.2% in July, while energy prices rose 0.1%. The “core” CPI, which excludes food and energy, rose 0.2% in July, also matching consensus expectations. Core prices are up 4.7% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – increased 0.3% in July and are up 1.1% in the past year. Real average weekly earnings are up 0.2% in the past year.

Implications:

More progress against inflation in July. But don’t get overly excited. The recent surge in energy prices came too late in July to affect the monthly numbers. It will hit in August, and could be enough to reverse the decline in YOY comparisons. Consumer prices rose 0.2% in July, matching consensus expectations, while the twelve-month came in at 3.2%, a huge improvement versus the 8.5% twelve-month change as of July 2022. In the past three months, the CPI is up at only a 1.9% annual rate, the smallest three-month reading since the onset of COVID. While that is welcome news, other data shows no one should be sanguine, especially given the rise in gas prices. “Core” prices – which exclude the effects of the typically volatile food and energy sectors – remain elevated, up at 3.1% and 4.1% annualized rates in the last three and six months, respectively. Rental inflation – both for actual tenants and the imputed rental value of owner-occupied homes – continue to run hot, up 0.5% for the month and running near or above a 6% annualized rate over three-, six-, and twelve-month timeframes. Meanwhile, a subset category of inflation that the Fed is watching closely – known as the “Super Core” – which excludes food, energy, other goods, and housing rents, rose 0.2% in July and is up 4.1% in last twelve months. Couple that with a resilient US labor market, Powell and Co. still have plenty of reason to keep monetary policy tight in the months to come. Looking at the details of today’s report, inflation was held down by several categories that declined in July, led by a dip in prices for airfare (-8.1%), used vehicles (-1.3%), and hospital services (-0.4%). The reason for the moderation in inflation this year is that the money supply stopped growing rapidly after surging in 2020-21. The M2 measure of money is down 3.6% versus a year ago. If this persists — and it remains to be seen whether it will — it would eventually bring inflation back down to the Fed’s 2.0% target. For now, the Fed has gained some traction in its fight against inflation, but the battle is not over. In other news this morning, initial claims for jobless benefits rose 21,000 to 248,000, while continuing claims fell 8,000 to 1.684 million. These figures suggest continued job growth in August, although not as fast as earlier this year.