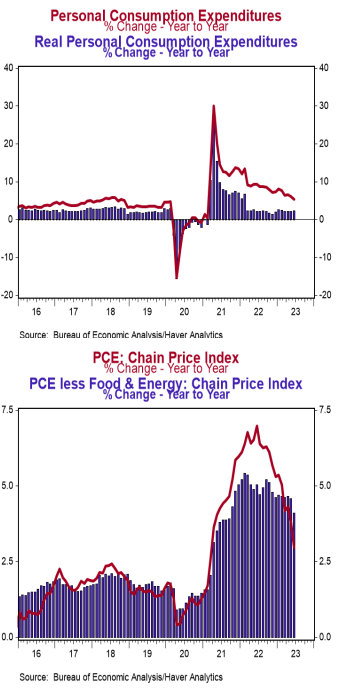

- Personal income rose 0.3% in June (+0.4% including revisions to prior months), lagging the consensus expected +0.5%. Personal consumption rose 0.5% in June (+0.6% including revisions to prior months), beating the consensus expected +0.4%. Personal income is up 5.3% in the past year, while spending has increased 5.4%.

- Disposable personal income (income after taxes) increased 0.3% in June (+0.4% including revisions to prior months) and is up 7.9% from a year ago.

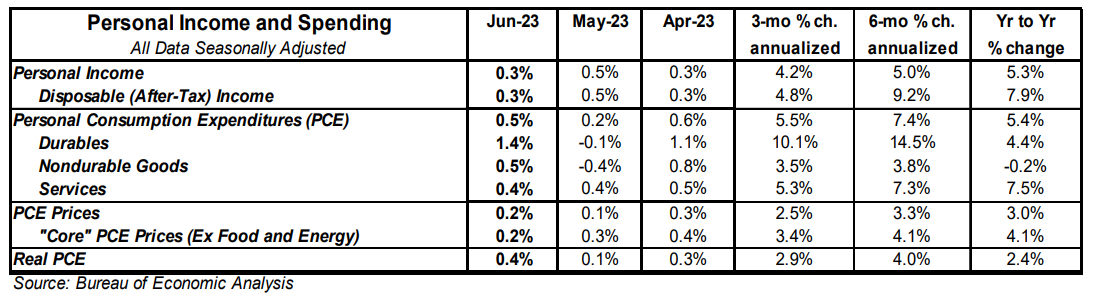

- The overall PCE deflator (consumer prices) rose 0.2% in June and is up 3.0% versus a year ago. The “core” PCE deflator, which excludes food and energy, also rose 0.2% in June and is up 4.1% in the past year.

- After adjusting for inflation, “real” consumption rose 0.4% in June and is up 2.4% from a year ago.

Implications:

Income and spending closed out the first half of 2023 on a healthy note, but consumer strength is also keeping the Fed on guard. The best news in today’s report was that incomes rose 0.3% in June and are up 5.3% in the last year, led by gains in private-sector wages & salaries (+0.6% for the month and up 5.9% year-to-year). Consumer spending outpaced incomes in June, with a pickup in spending across all major categories. Goods spending rebounded in June, up 0.8%, and, despite declining in seven of the last twelve months, remains up 1.5% in the past year (up 2.1% on a “real” inflation-adjusted basis as good prices have now declined from year-ago levels). Meanwhile spending on services has risen each and every month over the same period and is up 7.5% in the past year. The transition away from goods and toward services remains an ongoing theme. Given the surge in goods activity during COVID, we expect goods spending will struggle to keep pace as the economy continues to shift back toward a more “normal” mix of activity. On the inflation front, PCE prices – the Federal Reserve’s preferred measure of inflation – rose 0.2% in June, pushing the twelve-month comparison down to 3.0%. That said, the decline from the peak reading of 7.0% in June of last year has been heavily concentrated in the typically volatile food and energy categories. “Core” inflation, which excludes food and energy, is up 4.1% on a year ago comparison from the 5.4% peak last February. In other words, “core” inflation is taking a much slower slog lower. Note that the Fed is now closely watching a subset of inflation dubbed the “Super Core,” which is services only (no goods), excluding food, energy, and housing. That measure also rose 0.2% in June and is up 4.1% versus a year ago (down less than one percentage point from the 4.9% peak in November 2021). Inflation continues to take a toll on the economy, which is also feeling more of the effects of the decline in the money supply over the past year. The Fed’s fight is not over, and there is plenty of room to stumble before crossing the finish line. In recent manufacturing news, the Kansas City Fed index, a measure of factory activity in that area, ticked up to -11 in July from -12 in June, signaling continued contraction. On the housing front, pending home sales, which are contracts on existing homes, rose 0.3% in June after a 2.5% decline in May. Plugging these figures into our model suggests existing home sales will remain soft in July.