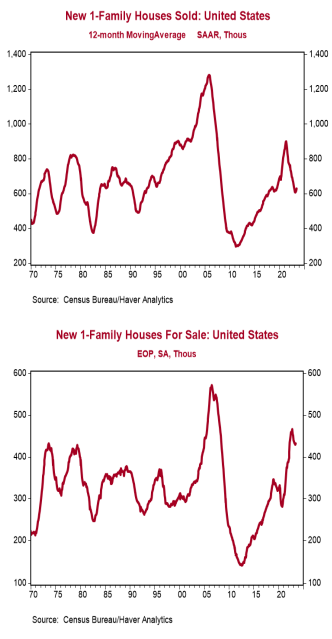

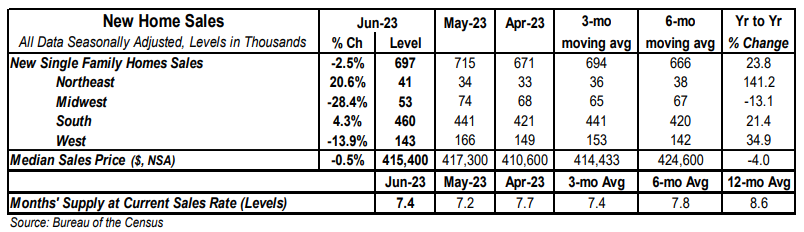

- New single-family home sales declined 2.5% in June to a 0.697 million annual rate, lagging the consensus expected 0.725 million. Sales are up 23.8% from a year ago.

- Sales in June fell in the Midwest and West but rose in the Northeast and South.

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) rose to 7.4 in June from 7.2 in May. The gain was due to both a slower pace of sales and a 3,000 unit increase in inventories.

- The median price of new homes sold was $415,400 in June, down 4.0% from a year ago. The average price of new homes sold was $494,700, up 4.8% versus last year.

Implications:

New home sales took a breather in June, posting a small decline following three consecutive months of gains. Despite the negative headline number, sales are on an upward trend recently and are 28.4% above the low in July of last year. However, they still remain well below the pandemic highs of 2020. The main issue with the US housing market has been declining affordability. Assuming a 20% down payment, the rise in mortgage rates since the Federal Reserve began its current tightening cycle amounts to a 21% increase in monthly payments on a new 30-year mortgage for the median new home. With 30-year mortgage rates currently sitting near 7.0%, financing costs remain a headwind. However, the median sales price of new homes has fallen by 16.4% from the peak late last year, which has helped sales activity begin to recover. While a lack of inventory had contributed to price gains in the past couple of years, in general, inventories have made substantial gains recently. The months’ supply of new homes (how long it would take to sell the current inventory at today’s sales pace) is now 7.4, up significantly from 3.3 early in the pandemic. Most importantly, the supply of completed single-family homes has more than doubled versus the bottom in 2022. This is in contrast to the market for existing homes which continues to struggle with an inventory problem, often due to the difficulty of convincing current homeowners to give up the low fixed-rate mortgages they locked-in during the pandemic. Though not a recipe for a significant rebound, more inventories should continue to help moderate new home prices and put a floor under sales activity. One problem with assessing housing activity is that the Federal Reserve held interest rates artificially low for more than a decade. With rates now in a more normal range, the sticker shock on mortgage rates for potential buyers is very real. However, we have had strong housing markets with rates at current levels in the past, and homebuyers will eventually adjust, possibly by looking at lower priced homes. Speaking of home prices, both the national Case-Shiller index and the FHFA index rose 0.7% in May. Notably, while the Case-Shiller index is still down from its peak in June by 0.9%, the FHFA index is now at a new all-time high and up 2.4% from the previous peak in June 2022. In recent manufacturing news, the Richmond Fed index, a measure of mid-Atlantic factory activity, fell to -9.0 in July from -8.0 in June, continuing to signal contraction. Finally, we got data on the M2 money supply yesterday which rose 0.2% in June, the second gain in a row following a long string of declines. That said, the money supply is still down 3.6% from a year ago and we are likely to feel the negative economic effects of that in the coming twelve months.