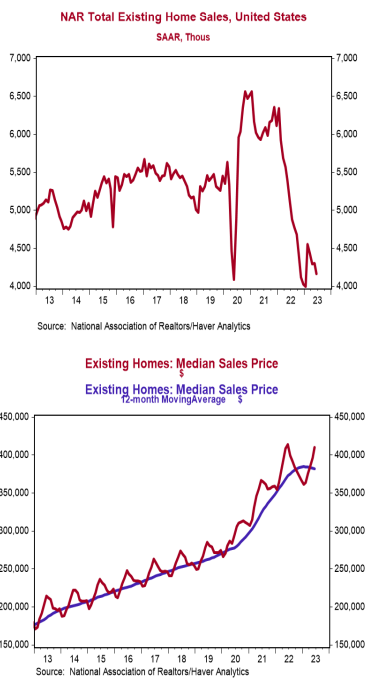

- Existing home sales declined 3.3% in June to a 4.160 million annual rate, narrowly lagging the consensus expected 4.200 million. Sales are down 18.9% versus a year ago.

- Sales in June fell in the South and West, rose in the Northeast, and remained unchanged in the Midwest. The drop in June was due to both single-family homes and condos/co-ops.

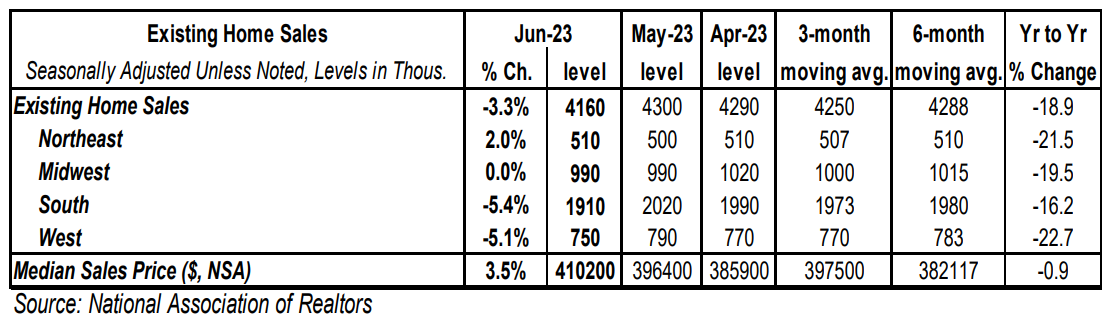

- The median price of an existing home rose to $410,200 in June (not seasonally adjusted) but is down 0.9% versus a year ago.

Implications:

There wasn’t much to get excited about in today’s report on existing home sales, which posted a small decline in June. We expect the outlook to be choppy moving forward as the housing market faces a series of crosswinds. First, mortgage rates that are currently hovering near 7% remain a headwind to activity. Assuming a 20% down payment, the rise in mortgage rates since the Federal Reserve began its current tightening cycle in March 2022 amounts to a 38% increase in monthly payments on a new 30-year mortgage for the median existing home. The shock of higher financing costs on non-homeowners (potential buyers) meant a short-term reduction in sales in 2022; but that negative impact should be diminishing as people adapt to a higher level of rates. While financing costs remain a burden, the good news for prospective buyers is that median prices have fallen slightly in the past year, which means buyers are no longer getting squeezed on both ends. However, many existing homeowners will be reluctant to sell due to a “mortgage lock-in” phenomenon, after buying or refinancing at much lower rates before 2022. That should limit future existing sales (and inventories). While we expect a continued moderation in national listing prices, a tight inventory of existing homes should prevent a repeat of 2008. Case in point, the months’ supply of homes (how long it would take to sell existing inventory at the current very slow sales pace) was 3.1 in June, well below the benchmark of 5.0 that the National Association of Realtors uses to denote a normal market. Finally, a weakening economy in which the Federal Reserve doesn’t act quickly to cut rates, because of high inflation, could be a headwind for home sales later this year. On top of this, new fee changes that went into effect May 1st as part of the Federal Housing Finance Agency’s push for affordable housing will effectively subsidize homebuyers and refinancers with riskier credit ratings by charging higher fees to those with good credit scores. These changes are likely to cause extreme confusion and result in pricier monthly mortgage payments for most homebuyers. Adding this altogether, expect sales and prices to drag on in the year ahead, with no persistent recovery in existing home sales until at least late 2023 or early 2024. In employment news this morning, initial claims for jobless benefits fell 9,000 last week to 228,000. Meanwhile, continuing claims rose 33,000 to 1.754 million. These figures suggest moderate job growth in July. Finally on the factory front, the Philadelphia Fed Index, which measures manufacturing sentiment in that region, rose slightly to a still weak reading of -13.5 in July from -13.7 in June.