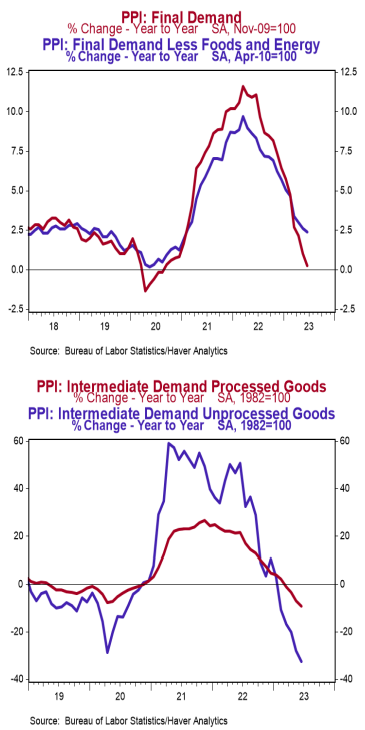

- The Producer Price Index (PPI) rose 0.1% in June, coming in below the consensus expected +0.2%. Producer prices are up 0.1% versus a year ago.

- Energy prices rose 0.7% in June, while food prices declined 0.1%. Producer prices excluding food and energy rose 0.1% in June and are up 2.4% versus a year ago.

- In the past year, prices for goods are down 4.4%, while prices for services have risen 2.3%. Private capital equipment prices rose 0.2% in June and are up 2.6% in the past year.

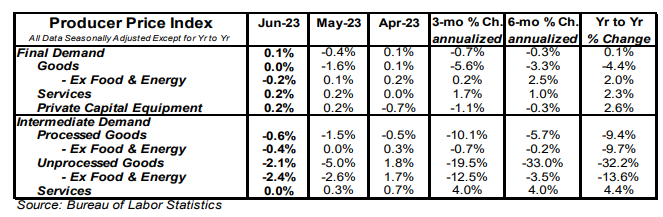

- Prices for intermediate processed goods fell 0.6% in June and are down 9.4% versus a year ago. Prices for intermediate unprocessed goods declined 2.1% in June and are down 32.2% versus a year ago.

Implications:

Producer prices rose 0.1% in June, but finished the first half of 2023 down from where we started the year. As you can see from the nearby chart, the year-ago comparison for producer prices, now up just 0.1%, has been moderating since the 11.7% peak in March 2022. Keep in mind, though, that part of the moderation is due to outsized jumps in inflation immediately after the invasion of Ukraine last year, which are now rolling off year-ago calculations. Taking a look at the details of today’s report shows that “core” prices – which excludes the typically volatile food and energy components – rose 0.1% in June and are up 2.4% in the past year. The services sector led prices higher in June, rising 0.2%, while goods prices were unchanged. Prices further back in the pipeline were decidedly lower, as prices for intermediate demand processed goods fell 0.6% in June while unprocessed goods dropped 2.1% and are down 32.2% in the past year. While some good news on inflation is welcome, data from yesterday’s CPI report shows the Fed’s job is not yet over. We expect the Fed to raise rates at the meeting later this month, and likely raise once more before the year is through. The economy is in the grips of a battle between the ongoing impacts from the tsunami of money that hit the system in 2020-2021 and is still being absorbed, while at the same time starting to show signs of the riptide from the Fed and Treasury Department now pulling money out of the system. Economic growth remains modestly positive, but a recession looks likely in the not-too-distant future. How the Fed will respond if/when a recession appears is very much an open question. The Fed’s failures in the 1970s should be a stark reminder of the painful results of easing before the battle against inflation is fully won. In employment news this morning, initial claims for jobless benefits declined 12,000 last week to 237,000, while continuing claims rose 11,000 to 1.729 million. These figures suggest continued job growth in July.