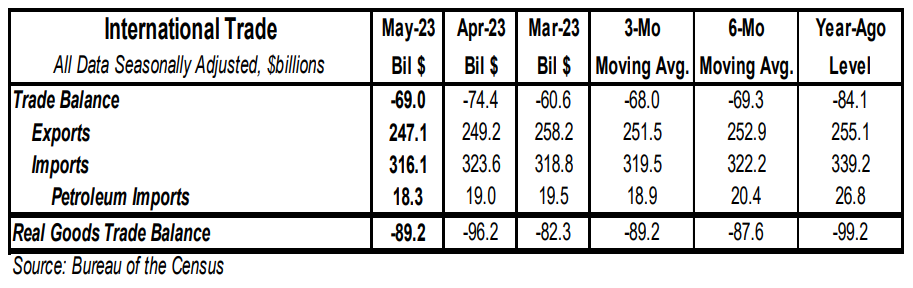

- The trade deficit in goods and services came in at $69.0 billion in May, matching consensus expectations.

- Exports declined by $2.1 billion, led by soybeans and crude oil. Imports declined by $7.5 billion, led by pharmaceuticals, cellphones & other household goods, and non-monetary gold.

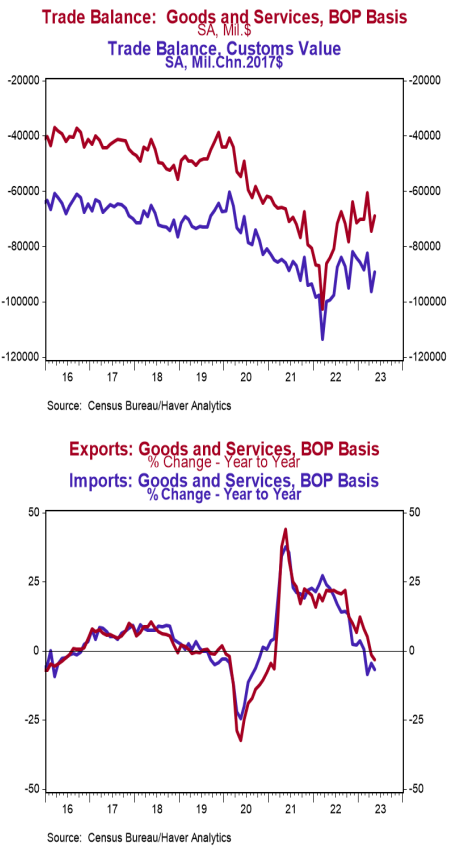

- In the last year, exports are down 3.2% while imports are down 6.8%.

- Compared to a year ago, the monthly trade deficit is $15.1 billion smaller; after adjusting for inflation, the “real” trade deficit in goods is $10.0 billion smaller than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications:

The trade deficit in goods and services declined to $69.0 billion in May as both imports and exports declined. We like to focus on the total volume of trade, imports plus exports, as it represents the extent of business and consumer interactions across the US border. This measure fell by $9.6 billion in May, is down 5.2% versus a year ago, and is now 5.8% lower than last year's peak in June. These declines are consistent with our forecast that the US is headed toward a recession. Imports declined by $7.5 billion in May and are down 6.8% versus a year ago indicating weakening demand for goods domestically, as there is a continuing trend toward spending on services. So far this year, imports from China are down 24.3% versus the same timeframe a year ago, dropping China from first to the third largest exporter to the US behind Mexico and Canada. Daily freight rates are also falling rapidly and back to pre-COVID levels or lower, as demand for shipping has also weakened. The New York Fed’s Global Supply Chain Pressure Index confirmed this again in May, with the index staying in negative territory, -1.71 standard deviations below the index’s historical average. Weaker demand coupled with an easing of parts shortages and less shipping congestion have pulled the indicator lower. Also notable in today’s report, the dollar value of US petroleum exports exceeded imports again. In the past year, US petroleum exports exceeded imports in all twelve months. For the full calendar year of 2022, the US became a net exporter again of petroleum products. What this means is much of the release from the Strategic Petroleum Reserve just flowed overseas. In employment news this morning, ADP’s measure of private payrolls increased 497,000 in June versus a consensus expected 225,000. In other employment news, initial claims for jobless benefits rose 12,000 last week to 248,000. Continuing claims fell 13,000 to 1.720 million. Putting these figures into our models suggests a gain of 250,000 in nonfarm payrolls in June (reported tomorrow morning). In other recent news, automakers sold cars and light trucks at a 15.8 million annual rate in June, up 4.4% from May and up 20.9% from a year ago.