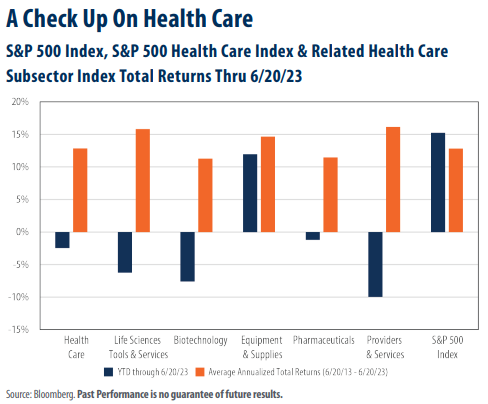

Today’s blog post focuses on the health care sector and shows its total returns over two distinct time frames: year-to-date (YTD) through 6/20/23 and over the trailing 10-year period ended on 6/20/23. For comparative purposes, we have included the return on the S&P 500 Index to reflect the broader market.

• Year-to-date through 6/20/23, the total returns posted by the S&P 500 Health Care Index and its subsectors are significantlylower than their 10-year averages through the same date.

Four of the six health care-related sectors/subsectors represented in today’s chart experienced total returns above those of the S&P 500 Index over the 10-year period ended 6/20/23. For comparison, we observe that the YTD total returns for each of those same data points are well below those of the broader index. In our estimation, this could represent an attractive entry point. Over the 10-year period ended 6/20/23, the S&P 500 Health Care Sector’s 12.83% average annual total return was the third highest of the 11 major sectors that comprise the S&P 500 Index, behind the S&P 500 Consumer Discretionary and S&P 500 Information Technology sectors, which registered average annual total returns of 13.02% and 21.57%, respectively (not in chart). • As of 6/21/23, the S&P 500 Health Care index carried a current Price to Earnings (P/E)

• As of 6/21/23, the S&P 500 Health Care index carried a current Price to Earnings (P/E) ratio of 16.73. For comparison, its 10-year average P/E ratio ended on the same date stood at 20.56.

• The expected revenue growth for the S&P 500 Health Care Index stood at 3.9% on 6/16/23, more than double that of the broader S&P 500 Index, which has estimated revenue growth of 1.85%, according to data from Bloomberg.

• The S&P 500 Health Care Index carried a weighting of 13.56% in the S&P 500 Index, the second highest behind the 28.05% weighting in Information Technology.

• The U.S. Census Bureau reported that there were 55.8 million people aged 65 or older living in the U.S. as of the 2020 census, up 38.6% from 40.3 million in 2010.

Takeaway

A recent study by Fidelity Investments revealed that a 65-year-old couple retiring in 2023 can expect to spend an average of $315,000 on healthcare expenses through retirement, and the figure is expected to rise. The Centers for Medicare and Medicaid Services project that national healthcare expenditures will grow by 5.4% per year on average through 2031. From our vantage point, the YTD total returns reflected in today’s chart could represent an attractive entry point for investors willing to take a long-term view with regard to the sector.