View from the Observation Deck

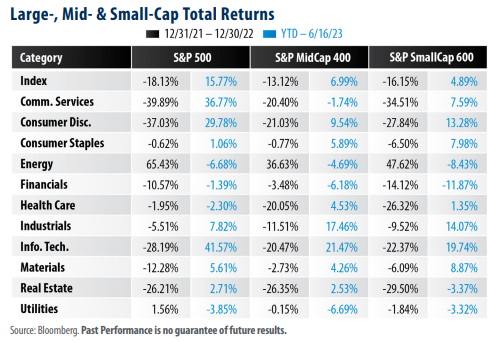

We update today’s table on a regular basis to provide insight into the variability of sector performance by market capitalization. As of the close on 6/16/23, the S&P 500 Index stood 8.07% below its all-time closing high, according to data from Bloomberg. The S&P MidCap 400 and S&P SmallCap 600 Indices stood 11.36% and 17.82% below their respective all-time highs.

- Large-cap stocks, as represented by the S&P 500 Index “(LargeCap Index”), posted year-to-date (YTD) total returns of

15.77%, significantly outperforming the S&P MidCap 600 (“MidCap Index”) and S&P SmallCap 400 (“SmallCap Index”)

indices, with total returns of 6.99% and 4.89%, respectively, over the period (see table). - Sector performance can vary widely by market cap and have a significant impact on overall index returns. Three of the

more extreme cases in 2022 were Health Care, Energy, and Consumer Discretionary. In 2023, it is Communication Services,

Financials, and Technology that appear to be contributing to the performance differential between the selected market caps.

Technology stocks, which have been the top performing sector YTD, represented 28.09% of the weight of the LargeCap Index at the close of 6/16/23. By comparison, technology stocks made up just 10.31% and 14.25% of the MidCap and SmallCap indices, respectively. Additionally, fallout from the recent global banking turmoil continues to have an outsized impact on mid and smallsized financial companies when compared to their larger counterparts. As the table reveals, financial companies in the MidCap and SmallCap indices have suffered YTD total returns of -6.18% and -11.87%, respectively. For comparative purposes, LargeCap financials have only experienced losses of -1.39%.

- As of the close on 6/16/23, the price-to-earnings (P/E) ratios of the three indices in today’s table were as follows: S&P 500 Index P/E: 19.72; S&P Midcap 400 Index P/E: 13.39; S&P SmallCap 600 Index P/E: 13.03

P/E ratios have increased for all three of these indices since our last post on this topic (Click here to view that post). The data continues to show that U.S. mid and small-sized companies offer more attractive P/E ratios when compared to their larger counterparts.

Takeaway

Echoing the situation we wrote about in April, when comparing valuations, mid-cap and small-cap stocks remain attractive compared to their large-cap peers. Over the 10-year period ended 6/16/23, the average monthly P/E ratios for the three indices was as follows: S&P 500 Index: 20.37; S&P MidCap 400 Index: 21.55, and S&P SmallCap 600 Index: 25.78, according to data from Bloomberg. As of market close on 6/16/23 the P/E ratios for those indices stood at 19.72, 13.39, and 13.03, respectively. That said, larger companies can be viewed by some investors as being more stable during periods of economic turmoil. One commonly watched leading indicator of economic health is the volume of cardboard box shipments. The U.S. corrugated products industry reported that sales declined by 11% in March alone. We maintain that should economic data continue to weaken in the coming months, it is possible that investors could persist in their flight to large cap stocks.