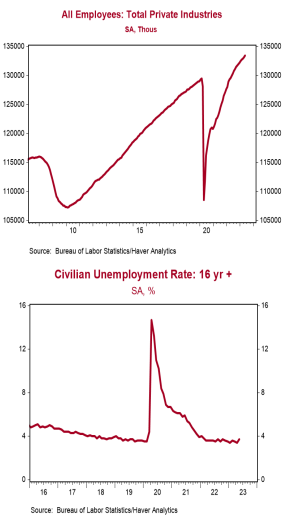

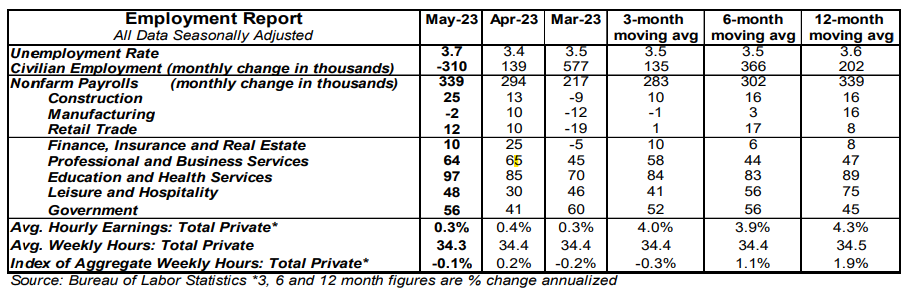

- Nonfarm payrolls increased 339,000 in May, easily beating the consensus expected 195,000. Payroll gains for March and April were revised up by a total of 93,000, bringing the net gain, including revisions, to 432,000.

- Private sector payrolls rose 283,000 in May and were revised up 57,000 in prior months. The largest increases in May were for education & health services (+97,000), professional & business services (+64,000, including temps), and government (+56,000). Manufacturing employment fell 2,000 in May.

- The unemployment rate rose to 3.7% in May from 3.4% in April.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.3% in May and are up 4.3% versus a year ago. Aggregate hours declined 0.1% in May and are up 1.9% from a year ago.

Implications:

If you have followed our recent reports on the US labor market the main theme has been ambiguity, and the data in May was no different. Once again, we have a report on the labor market with solid headlines but worrisome details. First, the good news. Nonfarm payrolls increased 339,000 in May, easily beating the consensus expected 195,000. On top of this, job gains from prior months were revised up by 93,000 as well, bringing the net gain to 432,000. However, if you stopped reading today’s report after these admittedly strong numbers, you wouldn’t be getting a full picture of the labor market. First, civilian employment, an alternative measure of job growth that includes small business start-ups, declined 310,000 in May. That means the gap between what was reported by the establishment (nonfarm payrolls) and household survey (civilian employment) that make up the overall labor market report was 649,000 in May. Notably, this is one of the largest divergences between the two measures since the early days of the Pandemic. Talk about ambiguous! The big decline in civilian employment, paired with a 130,000 person increase in the labor force, resulted in the unemployment rate rising to 3.7% in May. While it’s too early to tell, one explanation for the dichotomy between the institutional and household surveys in today’s report could be that smaller businesses are beginning to pare back their workforces while larger employers who can afford it continue to hoard labor. For example, despite the big headline gain for nonfarm payrolls, the total number of hours worked (which also comes from the institutional survey) slipped 0.1% in May. In other words, these businesses were hiring but there was less for their workers to do. In turn, this is consistent with our view that the labor market will be a lagging indicator as we enter the next recession. If larger employers hoard workers to fulfill future increases in business activity, but those increases don’t come, that just means more workers will get laid off later on. Finally, average hourly earnings increased 0.3% in May and are up 4.3% in the past year. However, wage growth should be taken in the context of the high inflation environment we are currently in, and with consumer prices up 4.9% as of May workers are at best treading water. Overall, today’s labor market report echoes a lot of the concerns we raised in this week’s Monday Morning Outlook. It’s easy to find surface level good news on the US economy, but the data behind the scenes leaves us feeling cautious. In other recent news, automakers sold cars and light trucks at a 15.0 million annual rate in May, down 6.5% from April but still up 19.6% from a year ago. In addition, sales of medium and heavy trucks hit a 558,000 annual rate in May, the fastest pace since 2019.