View from the Observation Deck

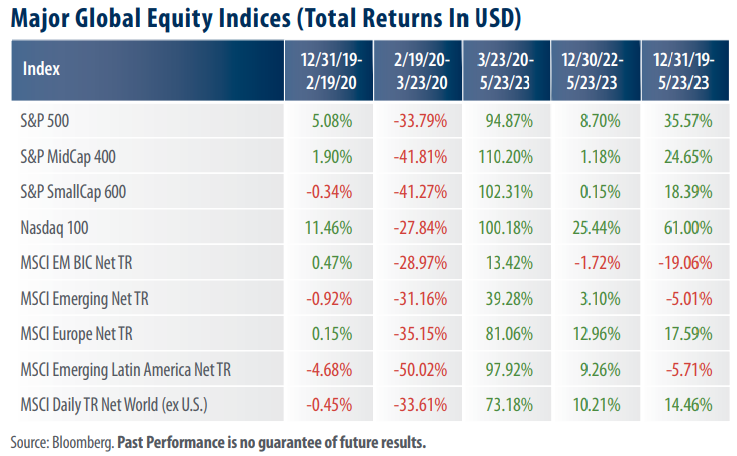

On Friday May 5, 2023, the Director-General of the World Health Organization (WHO) declared that the coronavirus 2019 disease (COVID-19) was no longer a public health emergency of international concern. We started this blog series on 5/7/20 (click here to view that original post), and have posted 10 updates (not including this one) since then. Given the WHO’s update to the pandemic, we thought it would be relevant to provide a recent snapshot of global equity performance. Today’s blog post features the total return performance figures for the major global stock indices over four specific periods since the start of 2020. There is quite a lot of data to review here, so let’s break it down and discuss a few relevant talking points.

The first column in the table above indicates that, with the exception of the S&P SmallCap 600 Index, U.S. equities were outperforming their foreign counterparts prior to the peak in the S&P 500 Index on 2/19/20. Due largely to the onset of coronavirus (COVID-19), a major shift in sentiment occurred after the close of trading on 2/19/20.

The second column captures the depth of the sell-off in the stock market in the U.S. and abroad. Notably, the S&P 500 Index crossed over into bear market territory (a 20% or more price decline from the most recent high) at the close of trading on 3/12/20. It only took 16 trading days, the fastest path to a bear market ever. The sell-off ceased on 3/23/20.

The third column shows the rebound in progress. The S&P 500 Index was highly volatile during this time frame, recovering from its previous bear market to set its all-time high on 1/3/22, then falling 25.43% on a price-only basis to a new bottom on 10/12/22. As reflected by the year-to-date returns in the table, the index has since bounced back from that low, but remains 13.57% below its all-time high as of 5/23/23. U.S. equities significantly outperformed their foreign counterparts over the time frame in the column.

The fourth column reflects the year-to-date (YTD) total returns through 5/23/23. As reflected by the table, the NASDAQ 100 has far outpaced any of the other indices in the table so far this year.

The fifth column reflects total returns since the start of 2020. The U.S. equity indices are dominating their foreign counterparts over the period.

Takeaway

One of the more obvious takeaways from today’s table is just how resilient the global equity markets have proven to be in the face of uncertainty. Between the onset of COVID-19, surging global inflation, the tightening of monetary policy, Russia’s invasion of Ukraine, and the more recent banking turmoil, to name a few, companies around the globe have overcome a myriad of obstacles to growth. From 12/31/19-5/23/23, the U.S. dollar rose by 7.36% against a basket of major currencies, as measured by the U.S. Dollar Index (DXY), according to Bloomberg (not in table). As indicated by the returns in the table, the increase in the U.S. dollar has proven to be a drag on the performance of unhedged foreign securities held by U.S. investors over the period. Even so, with the exception of Emerging Markets and Latin America, equities have enjoyed positive total returns over the period that began on 12/31/19.